Methanol Weekly Report 15 April 2017

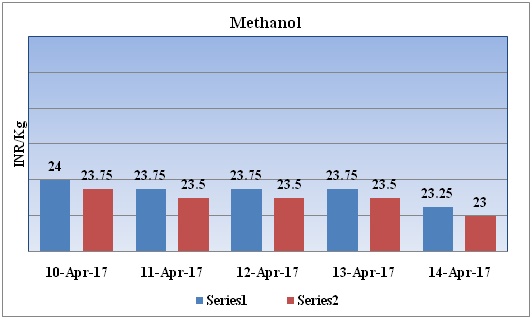

Weekly Price Trend: 10-04-2017 to 14-04-2017

- The above graph focuses on the Methanol price trend for the current week. Prices have followed weak inclination for this week. By the end of the week prices were assessed around Rs.23.25/Kg for Kandla and Rs 23/kg Mumbai ports.

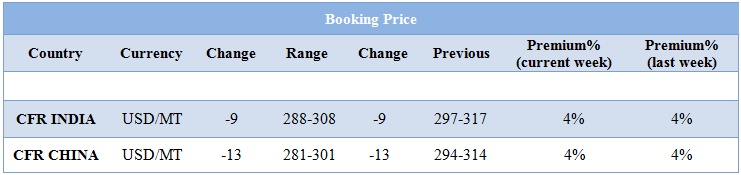

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed weak inclination and by the end of the week prices were evaluated at Rs 23.25/kg for Kandla and Rs 23/kg for Mumbai ports.

- CFR India prices were assessed in the range of USD 288-308/MTS. Prices have plunged USD 9/mt in compares to previous week.

- FOB Korea prices of methanol were evaluated around at the level of USD 329/mt.

- CFR China prices were assessed in the range of USD 281-301/MT prices have decreased in compares to previous week.

- This week methanol market have revealed weak with bearish sentiments.

- As per report, presently methanol market is moving with sluggish velocity market players have been uncertain for upcoming market outlook.

- This week oil prices oil prices have followed little volatility but overall it was strong week for crude. On Thursday that supply and demand in the global oil market were close to matching after a fall in stockpiles in developed countries in March.

- As per report, the market has been oversupplied for three years, prompting members of the OPEC and some non-OPEC producers to agree to cut output in the first six months of 2017 to rein in the glut. OPEC meets on May 25 to consider extending the cuts beyond June.

- U.S. production to continue rising, both onshore and offshore, which will act as a headwind for the market.

- As per market analyst, refinery runs are picking up, and driving season is around the corner, so inventories will start going down soon. Amid so much uncertainty, the only thing that is certain is that crude oil production is growing, and there are no signs that this will change while the going is good and prices stay above $50 a barrel.

- On Thursday, closing crude values have increased.WTI on NYME closed at $53.18/bbl, prices have increased by $0.07/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.03/bbl in compared to last trading and was assessed around $55.89/bbl.

$1 = Rs. 64.41

Import Custom Ex. Rate USD/ INR: 65.90

Export Custom Ex. Rate USD/ INR: 64.20