Methanol Weekly Report 15 July 2017

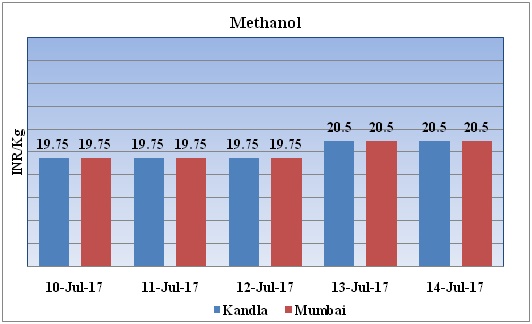

Weekly Price Trend: 10-07-2017 to 14-07-2017

The above graph focuses on the Methanol price trend for the current week. Prices have followed up inclination for this week. By the end of the week prices were assessed around Rs.20.5/Kg for Kandla and Rs 20.5/kg Mumbai ports.

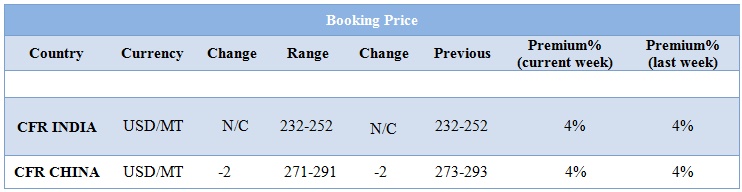

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed up inclination and by the end of the week prices were evaluated at Rs 20.5/kg for Kandla and Rs 20.5/kg for Mumbai ports.

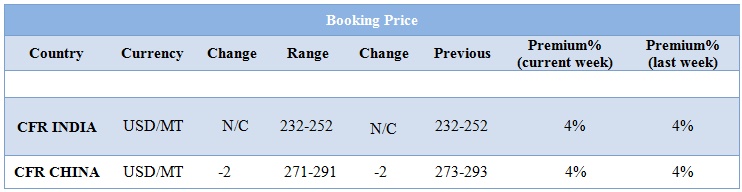

- CFR India prices were assessed in the range of USD 232-252/MTS. Prices have remained firm in compares to previous week.

- FOB Korea prices of methanol were evaluated around at the level of USD 292/mt.

- There is complete uncertainty prevailing for Methanol prices in China market. Sentiments were trending for hike in values.

- According to reports the ports are filled with inventory stocks of Methanol on other side there is sluggish demand in domestic market coupled with domestic heavy supply.

- Although there has been heavy consumption of chemical by MTO plants. This high demand is strong factor for rise in prices but on other side many domestic plants are likely to restart their units after brief maintenance along with rise in their existing capacities.

- This confusion has been setting Methanol values on very different note.

- This week Crude oil prices have followed up inclination as Saudi Arabia is going to cut exports of crude oil to the United States, but this is going to be a short-term effect on the market as the United States becomes much more energy independent.

- On Thursday, closing crude values have increased.WTI on NYME closed at $46.08/bbl, prices have increased by $0.59/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.68/bbl in compared to last trading and was assessed around $48.42/bbl.

- As per market source, the oil market could stay oversupplied for longer than expected due to rising production and limited output cuts by some OPEC exporters. Rising consumption in Germany and the United States was helping boost oil demand. OPEC said its production rose by 393,000 barrels per day in June to 32.611 million bpd.

$1 = Rs. 64.45

Import Custom Ex. Rate USD/ INR: 65.65

Export Custom Ex. Rate USD/ INR: 63.95