Methanol Weekly Report 16 Sep 2017

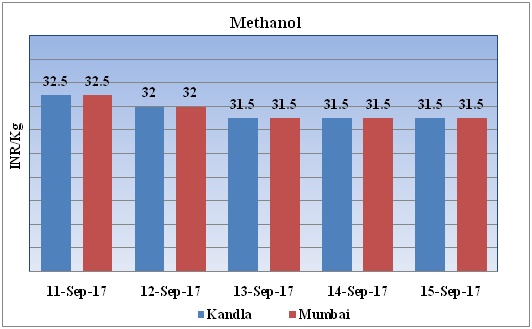

Weekly Price Trend: 11-09-2017 to 15-09-2017

The above graph focuses on the Methanol price trend for the current week. Prices have followed weak inclination for this week. By the end of the week prices were assessed around Rs.31.5/Kg for Kandla and Rs 31.5/kg Mumbai ports.

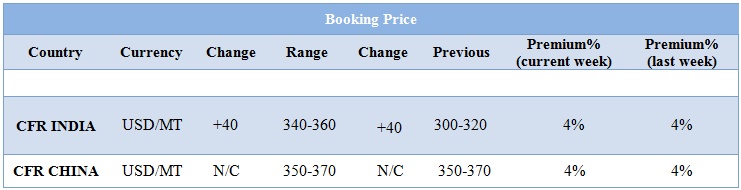

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed weak inclination and by the end of the week prices were evaluated at Rs 31.5/kg for Kandla and Rs 31.5/kg for Mumbai ports.

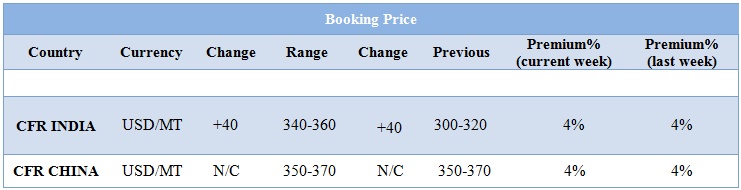

- CFR India prices were assessed in the range of USD 340-360/MTS. Prices have increased in compares to previous week.

- This week in China market prices have remained firm CFR China prices were assessed at the level of USD 360/mt.

- CFR South East Asia prices of Methanol were evaluated at USD 368/mt.

- Taiwan’s methanol imports plunged by 17.9% in July, As per report.

- This week domestic methanol market has remained stable-to-soft no major deals and discussion has been heard.

- In China market on account of supply shortage and falling inventory prices hae increased last week.

- Methanol stock in china producers remains quite low recently. Plants in Northwest China are not keen to sell, so producers anticipate high pricing in near term.

- Recently Methanol price is fluctuating due to this market player have adopted observing stances.

- Some players expect that methanol market in September-October will go up.

- Import may decrease and prices for imported materials in coastal regions may be driven up further.

- Furthermore, end-users are expected to build up methanol stocks to meet the requirements for feedstock during National Day holiday in early October.

- This week has been highly positive for crude values in international market. On Thursday closing, crude values gained in the international market.WTI on NYME closed at $49.89/bbl, prices improved by 0.59 in compared to last closing prices.While, Brent on Inter Continental Exchange was assessed at the rate of $55.47/bbl increased by 0.31/bbl on Wednesday.

- Market analyst said that demand for crude is better than expected and the persistently oversupplied market is finally tightening. Traders will be looking for signs that brimming stockpiles of oil around the world continue to fall towards the five-year average.

- U.S. Gulf oil refineries are slowly returning after storms. persistent weakness in the U.S. dollar index, has prompted bullish sentiment in the oil market, players are anticipating that this could quicken the pace of oil market rebalancing.

$1 = Rs. 64.07

Import Custom Ex. Rate USD/ INR: 64.90

Export Custom Ex. Rate USD/ INR: 63.25