Methanol Weekly Report 23 June 2018

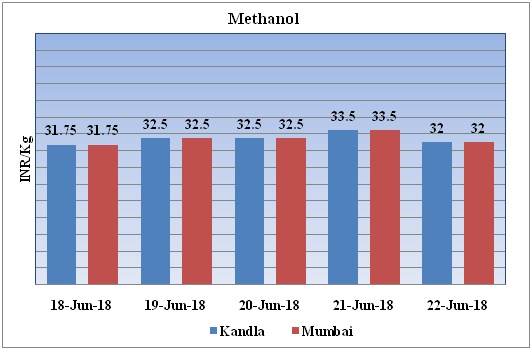

Weekly Price Trend: 18-06-2018 to 22-06-2018

The above graph focuses on the Methanol price trend for the current week. Prices have followed volatile trend for this week. By the end of the week prices were assessed around Rs 32/Kg for Kandla and Rs 32/kg Mumbai ports.

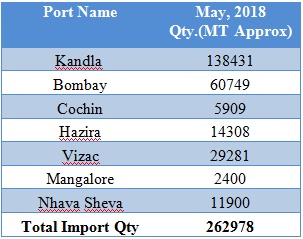

Total import at various ports of India May, 2018

Above graph represent the total imported quantity of Methanol for the month of May, 2018.

Last month total import was around 262978MT. As per chart last month at Kandla port imports was higher while at Mangalore port import was lesser.

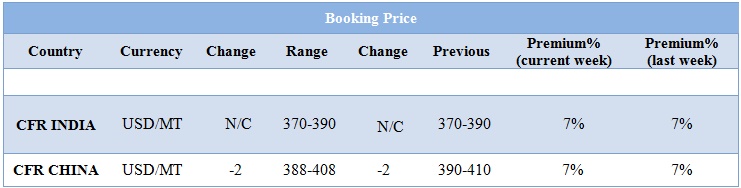

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed little volatility and by the end of the week prices were evaluated at Rs 32/kg for Kandla and Rs 32/kg for Mumbai ports.

- CFR India prices were assessed in the range of USD 380/MTS. Prices have remained firm in compares to previous week.

- This week CFR India prices have remained firm as market is moving with uncertain velocity.

- Norway based Equiinor to restart its Methanol plant after planned maintenance. Earlier the unit was shut down in Mid of May and was expected to resume production by mid of June. Equinor was earlier known as Statoil. The unit is based at Tjelbergodden in Norway and has the production capacity of around 9,00,000 mt/year.

- Malaysia based Petronas Chemicals will restart its no2 Methanol unit today. Earlier the unit was shut down on Tuesday due to some technical fault. The issue has been now sorted out. The plant is based at Labuan and has the manufacturing capacity of 1.7million mt/year. Petronas' other methanol plant at Labuan, the No 1 unit with a capacity of 660,000 mt/year, is continuing to operate normally.

- BioMethanol has shut down its Methnaol unit for maintenance turnaround. The unit was shut down in the first week of June and is likely to remain off-stream for around one month. Unit is based at Netherlands and has the manufacturing capacity of 500 Kt/Year.

- China based Zhejiang Xingxing will soon to restart its MTO unit after brief maintenance schedule.Earlier the unit was shut donw on 25th May for an annual maintenance program. The unit is based at Zhejiang province of China and has the manufacturing capacity of MTO around 600 Kt/year. The other integrated downstream products of the company are PP and MEG EO.

- China based Ningbo Fundo will soon restart its MTO unit after brief maintenance schedule. Earlier the unit was shut down on 5th May for an annual maintenance program. The unit is based at Zhejiang province of China and has the manufacturing capacity of MTO around 600 Kt/year. The other integrated downstream products of the company are PP and MEG.

- CFR China prices of methanol were evaluated at USD 392/mt.

- FOB Korea prices of Methanol were evaluated USD 423/mt.

- CFR South East Asia prices of Methanol USD 424/mt.

- As per report, price volatility in global methanol markets is set to increase amid new production and growing demand from methanol-to-olefins plants in China.

- In US, Saudi Arabia and Iran increase in methanol production will continue to impact the direction of prices, with new plants coming online in the following years likely to change supply.

- As per market players methanol demand from MTO plants have risen in recent years, outstripping demand from other traditional sectors such as formaldehyde, and it is set to increase in the future.

- This week crude oil prices have followed volatile trend. on Thursday Global benchmark Brent crude extended losses ahead of Friday's meeting of the OPEC, where producers are expected to boost output.

- On Thursday, closing crude values have plunged. WTI on NYME closed at $65.54/bbl; prices have decreased by $0.17/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $1.69/bbl in compare to last closing price and was assessed around $73.05/bbl.

- Today oil prices rose by more than 1 percent in early Asian trading, pushed up by uncertainty over whether OPEC would manage to agree a production increase at a meeting in Vienna later in the day.

$1 = Rs. 67.84

Import Custom Ex. Rate USD/ INR: 69.10

Export Custom Ex. Rate USD/ INR: 67.40