Methanol Weekly Report 24 Feb 2018

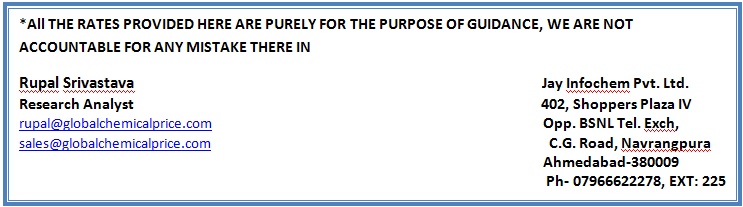

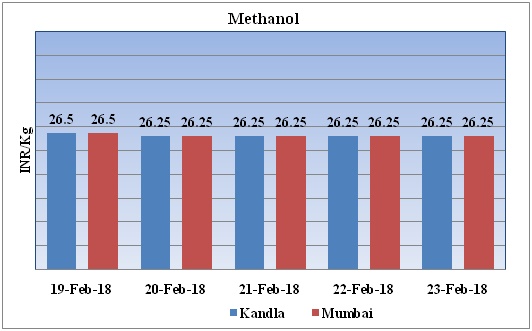

Weekly Price Trend: 19-02-2018 to 23-02-2018

The above graph focuses on the Methanol price trend for the current week. Prices have followed weak trend for this week. By the end of the week prices were assessed around Rs 26.25/Kg for Kandla and Rs 26.25/kg Mumbai ports.

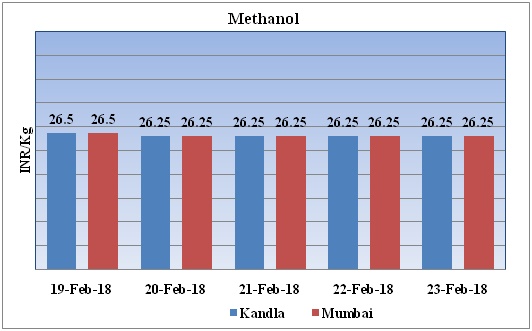

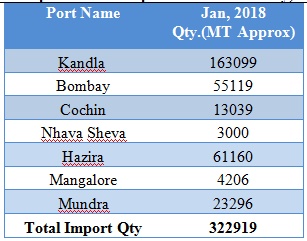

Total import at various ports of India January, 2018

Above graph represents the total imported quantity of Methanol for the month of January 2018. As per graph previous month total imports was around 322919MT. At Kandla port imports were higher while at Nhava Sheva port imports were lesser.

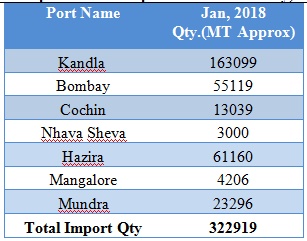

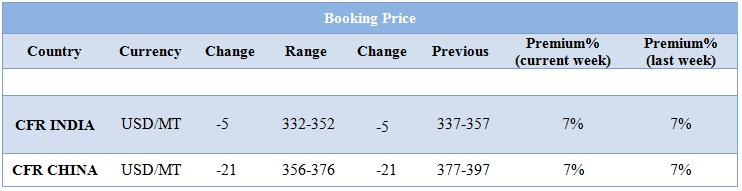

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed weak trend and by the end of the week prices were evaluated at Rs 26.25/kg for Kandla and Rs 26.25/kg for Mumbai ports.

- CFR India prices were assessed in the range of USD 342/MTS. Prices have decreased by USD 5/mt in compares to previous week.

- CFR China prices of methanol were evaluated at USD 366/mt.

- FOB Korea prices of Methanol were evaluated USD 399/mt.

- This week methanol market has remained soft-to-stable as no major deals and discussion has been heard from end users.

- In China on Lunar New year holiday market have remained stagnant.

- As per repot, Southern Chemical Corp rolled its March contract price.

- This year global methanol production capacity is expected to go up but most of the new unit will come on line after 1st quarter.

- As per source, in china natural gas based some methanol plants are likely to restart after spring festival holiday. As the heating season is expected to end and the restrictions on gas-based methanol production may get lifted. This will escalate the production.

- As per market source, the startup date of new methanol plant in Iran anticipated to delay to the second half of 2018 or even later.

- For upcoming methanol outlook, the natural gas based plants will restart but increased material availability will be controlled by the plants turnaround and lower imports. Market players are anticipating that demand for methanol will take an affirmative move as consumption from downstream sectors will escalate. On account of positive bullish demand sentiments from downstream methanol prices also will swell.

- Europe methanol prices also have plunged on tight market situation.

- This week oil prices have followed mixed trend. Oil prices rose on Thursday, on U.S. crude stocks unexpectedly declined and also by a drop in the dollar.

- On Thursday, closing crude values have increased. WTI on NYME closed at $62.77/bbl; prices have increased by $1.09/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.97/bbl in compared to last trading and was assessed around $66.39/bbl.

- Crude inventories had been forecast to rise 1.8 million barrels, as stocks seasonally increase when refineries cut intake to conduct maintenance. As per source, the unexpected fall in oil inventories in the U.S. should see support for crude oil prices remain strong.

$1 = Rs. 64.73

Import Custom Ex. Rate USD/ INR: 64.50

Export Custom Ex. Rate USD/ INR: 62.85