Methanol Weekly Report 24 June 2017

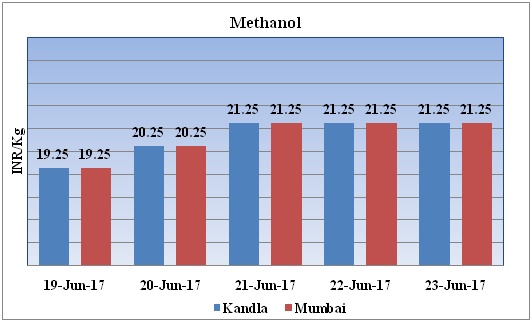

Weekly Price Trend: 19-06-2017 to 23-06-2017

The above graph focuses on the Methanol price trend for the current week. Prices have followed up inclination for this week. By the end of the week prices were assessed around Rs.21.25/Kg for Kandla and Rs 21.25/kg Mumbai ports.

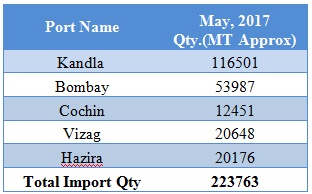

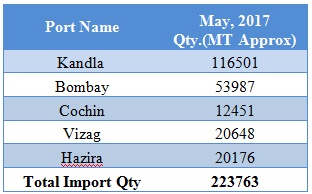

Total import at various ports of India May, 2017

The above chart depicts the total imported quantity of Methanol for the month of May, 2017. In the month of May total imported quantity of Methanol was around 223763MT. As per chart last month at Kandla port imports were higher, while at Cochin port imports were lower.

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed up inclination and by the end of the week prices were evaluated at Rs 21.25/kg for Kandla and Rs 21.25/kg for Mumbai ports.

- CFR India prices were assessed in the range of USD 230-250/MTS. Prices have increased by USD 3/mt in compares to previous week.

- FOB Korea prices of methanol were evaluated around at the level of USD 286/mt.

- CFR China prices were assessed in the range of USD 260-280/MT prices have remained firm in compares to previous week.

- This week in domestic market methanol demand sentiments have improved which has resulted in increase in the prices.

- This week China methanol market was moving with volatile velocity.

- Presently methanol market is moving with up velocity but This hike is temporary as major plants across the globe will restart their production post annual maintenance schedule.

- To name a few Brunei’s BMC restarted its unit in first week of June having the capacity of 850 kt/year.

- Saudi Arabia’s Ar Razi planning to start its 1.7 million tons/yr plant, which was closed for maintenance on Apr 25. Iran based Zagros closed one of its 1.65 million tons/yr plant temporarily for 2-3 days last week and soon restarted it.

- Production of these units along with restart of many China based local units is bound to create impact on bulk methanol supply and its values. The current hike is likely to be short lived with abundant supply in near future.

- This week oil prices have followed mixed trend. The oil market posted its worst performance in the first six months in two decades effectively signaling its refusal to accept the effectiveness of the OPEC statement and its desire for further production cuts.

- As per report, OPEC and Russia tried to stabilize prices with cuts at around $50-$60 per barrel, but this week Brent prices fell toward $44 per barrel on persistent oversupply worries.

- On Thursday Crude oil rose moderately following a Wednesday in which the commodity bottomed just above $42 per barrel.

- On Thursday, closing crude values have increased.WTI on NYME closed at $42.74/bbl, prices have increased by $0.21/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.40/bbl in compared to last trading and was assessed around $45.22/bbl.

$1 = Rs. 64.52

Import Custom Ex. Rate USD/ INR: 65.15

Export Custom Ex. Rate USD/ INR: 63.50