Methanol Weekly Report 28 April 2018

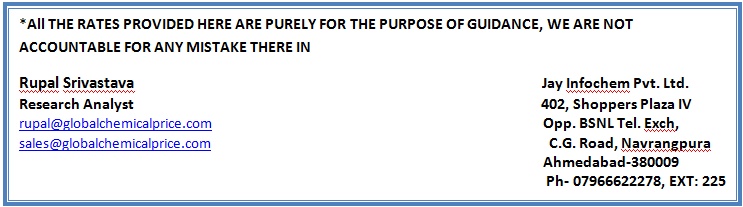

Weekly Price Trend: 23-04-2018 to 27-04-2018

The above graph focuses on the Methanol price trend for the current week. Prices have followed up trend for this week. By the end of the week prices were assessed around Rs 33.25/Kg for Kandla and Rs 33.25/kg Mumbai ports.

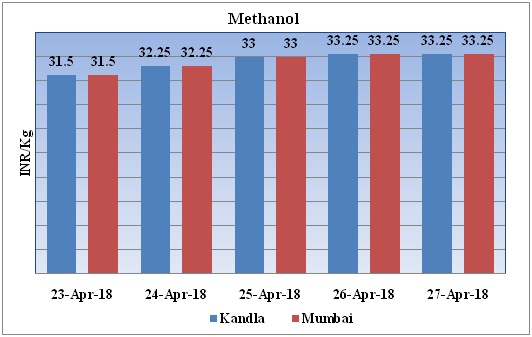

Total import at various ports of India March, 2018

Above chart represents the total imported quantity of Methanol for the month of March, 2018.

Last month total imports were around 222909MT.

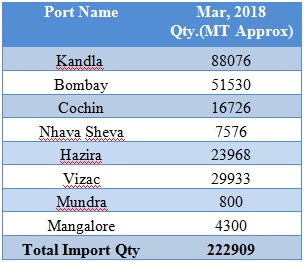

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed up trend and by the end of the week prices were evaluated at Rs 33.25/kg for Kandla and Rs 33.25/kg for Mumbai ports.

- CFR India prices were assessed in the range of USD 404/MTS. Prices have increased by USD 10/mt in compares to previous week.

- CFR China prices of methanol were evaluated at USD 398/mt.

- FOB Korea prices of Methanol were evaluated USD 407/mt.

- This week methanol prices have escalated on increased demand and lower supply.

- Methanol prices have escalated sharply. China methanol prices were higher on tight supply situation. Average operating rate of domestic plants plunged in turnaround season and some overseas plants in Middle East and Southeast Asia are shut for maintenance.

- Market predictors said that, previous week methanol prices had increased on account of shortage of material and prices were at its peak level. In near term it is anticipated that supply demand fundamental will settle and then prices will go down as further increase in prices is limited.

- Canada based Methanex has posted its North American and Asian contract prices for the month of May 2018. Prices posted for the region of North America are USD 496/MT. There has been no change made in the prices Asia Pacific region. Prices posted are USD 460/MT. These prices are valied till 31st May 2018.

- Methanex has acquired land for a third methanol plant in Geismar, adjacent to its two existing methanol plants there. Methanex is still probably a year away from making a final investment decision. It would take 9-12 months to get a FID on the project and that there would be no significant capital spent on the project until late 2019 or 2020. Methanex said it was considering two sites for a potential new plant, one in Geismar and the other in Medicine Hat, Alberta. As per report, Methanex spends $20m/month on natural gas for its two Louisiana plants. The proposed new plant would be a new-build unit with a capacity of 1.8m tonnnes/year, much larger than the two 1m tonne/year plants in Geismar now.

- Fanavaran Petrochemical Company has shut down its Methanol unit for maintenance turnaround. The unit has been put off-stream as per annual maintenance schedule.The unit was shut down on 20th April 2018. The unit is likely to remain off-stream for around 25 days. Unit is based at BandarImam Khomeini in Iran and has the manufacturing capacity of 1,000,000 mt/year.

- OCI announced in a statement that mechanical work has been completed for world’s alsrgest nethanol plant. This unit is based at Texas in US. The unit will be commissioned soon and will start running in a month or two. The new OCI Natgasoline unit still has a vague start-up date. The release said the unit’s first production of methanol is scheduled for the second quarter, which has been industry conventional wisdom for most of 2018.

- This week oil prices have followed little volatility at the end of the week prices have escalated. On Thursday oil prices increased, supported by expectations of renewed U.S. sanctions on Iran, declining output in Venezuela and ongoing strong demand.

- On Thursday, closing crude values have increased. WTI on NYME closed at $68.19/bbl; prices have increased by $0.14/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.74/bbl in compared to last trading and was assessed around $74.74/bbl.

- Venezuela's plunging output and looming U.S. sanctions against Iran come against a backdrop of strong demand, especially in Asia, the world's biggest oil consuming region. However, not all market indicators point towards tighter supplies. Soaring U.S. oil production and exports are holding back further price gains.

$1 = Rs. 65.00

Import Custom Ex. Rate USD/ INR: 66.70

Export Custom Ex. Rate USD/ INR: 65.00