Methanol Weekly Report 29 April 2017

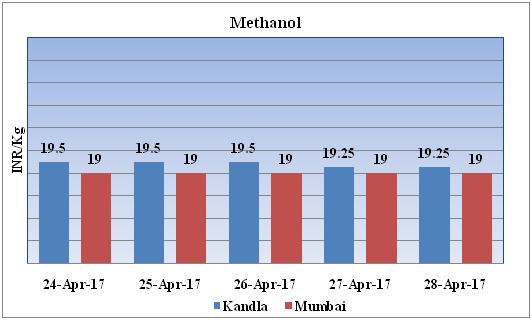

Weekly Price Trend: 24-04-2017 to 28-04-2017

- The above graph focuses on the Methanol price trend for the current week. Prices have followed weak inclination for this week. By the end of the week prices were assessed around Rs.20.5/Kg for Kandla and Rs 20.25/kg Mumbai ports.

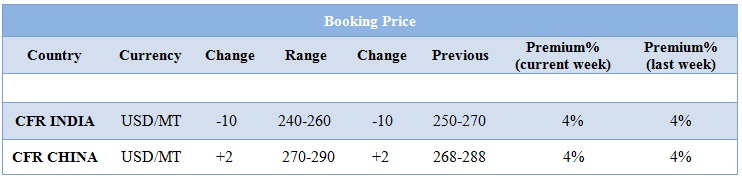

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market prices of Methanol have followed weak inclination and by the end of the week prices were evaluated at Rs 19.5/kg for Kandla and Rs 19/kg for Mumbai ports.

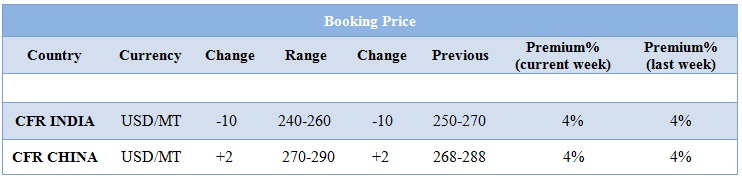

- CFR India prices were assessed in the range of USD 240-370/MTS. Prices have plunged USD 10/mt in compares to previous week.

- FOB Korea prices of methanol were evaluated around at the level of USD 319/mt.

- CFR China prices were assessed in the range of USD 270-290/MT prices have increased in compares to previous week.

- This week methanol market has remained weak with bearish sentiments.

- This week methanol prices have plunged with the decline in the demand from end users across region.

- Some market players have said that material is available in good amount while downstream demand has been slower.

- In china this week had closed on higher knot as in near term market will be close for May holiday.

- As per report, Methanex may restart one Chile methanol plant.

- China coal-to-olefins projects to slow on emissions control.

- The global methanol market has been estimated at USD 31.02 billion in 2016 and is projected to reach USD 51.6 billion by 2021.

- Global Methanol market is growing at a CAGR of 10.70% during the forecast period, 2016 to 2021.

- As per report, recently diverse new markets are growing for methanol due to the production of light olefins from methanol, methanol to gasoline conversion, and the increasing use of methanol as a fuel.

- In near term methanol market outlook will remain bearish demand will stay constrained and with the start of plant supply is anticipated to go up. Demand for methanol in MTO production is expected to decrease further, said by market players.

- Through the week oil prices have remained volatile. As per recent data in last 15 days oil prices sharply have stabbed rapidly, WTI from $53 a barrel down to $48 while Brent declined from $55 to $51. The falling oil means weakening economic demand, the reality is that oil is being driven by increased supply. On Thursday oil prices have plunged as the resume of two key Libyan oilfields and concerns about dreary gasoline demand fed concern over whether major oil producers can lessen the glut of global inventories.

- On Thursday, closing crude values have decreased.WTI on NYME closed at $48.97/bbl, prices have increased by $0.65/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.38/bbl in compared to last trading and was assessed around $51.44/bbl.

- As per market analyst As gas prices drop, that creates an undertow for the entire crude oil market. The outlook for oil prices will remain unstable. decline in crude prices and therefore petroleum product prices also means corresponding reduction in prices of some of the raw materials for the petrochemical industry. Hence, it can be a factor in improving the profitability of that industry.

$1 = Rs. 64.24

Import Custom Ex. Rate USD/ INR: 65.55

Export Custom Ex. Rate USD/ INR: 63.85