Mixed Xylene Weekly Report 06 May 2017

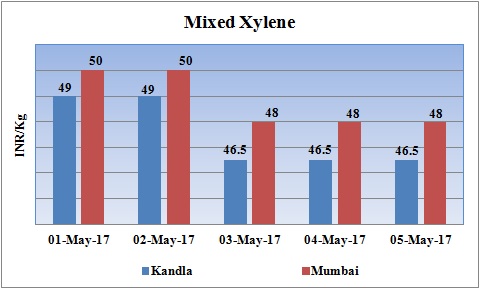

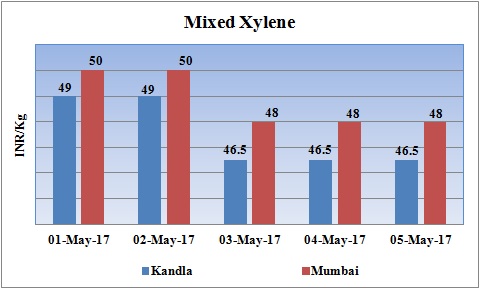

Weekly Price Trend: 01-05-2017 to 05-05-2017

- The above given graph focuses on the Mixed Xylene price trend for the current week.

- Domestic prices ofMixed Xylene remained soft for this week. Prices were assessed at the level of Rs.46.5/Kg for Kandla port and Rs.48/Kg for Mumbai port.

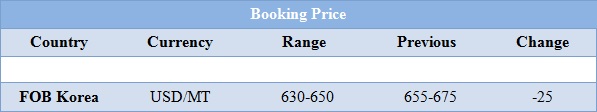

Booking Scenario

INDIA

- Mixed Xylene prices were assessed around Rs.46.5/Kg at Kandla port andRs.48/Kg for Mumbai port.

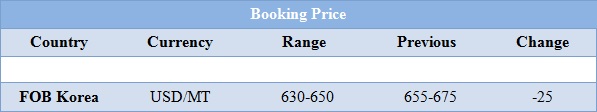

- International prices of Isomer grade Mixed Xylene declined significantly for this week. Prices were assessed in the range of USD 630-650/MTS, reduced by USD 25/MTS in compare to last week’s closing values.

- CFR SE Asia prices were assessed in the range of USD 645-665/MT, reduced by USD 25/MTS in compare to last week’s assessed values.

- On other side there has been heavy production of Para Xylene has started in the country by RIL. With starting of new addition capacity of plant in December, TIL has become the second largest producer of Para Xylene in the world. Starting of 2.2mln mt/year unit in Jamnagar has escalated the total capacity to 4.2 mln mt/year. Company is noe planning to enter in the ACP of chemical. It is in discussion with Hanwha Total of South Korea for Asian Contract Prices negotiations.

- According to traders and other ACP participants, the advantage the ACP settlement affords large producers is a guaranteed outlet for cargoes, while for buyers, stability of supply is afforded, at a fixed price.

- Price trend in crude values continue to remain volatile. As week proceeded the weakening of crude values was observed. On Thursday oil prices crashed to five-month lows as concerns about global oversupply wiped out all of the price gains since OPEC's move to cut output.

- Analysts agreed the steep price falls would likely force OPEC members to extend production cuts later this month, but the prospect of deeper cuts appeared wiry. Again OPEC is scheduled to meet on May 25 to decide whether to extend the cuts.

- On Thursday, closing crude values decreased.WTI on NYME closed at $45.52/bbl, prices decreased by $2.30/bbl in compared to last closing values. While Brent on Inter Continental Exchange decreased by $2.41/bbl in compared to last trading and was assessed around $48.38/bbl.

- Market experts believe that the current rate of cuts is sufficient to result in demand outstripping global output by 1 million barrels a day in the second half of 2017 as seasonal demand picks up. It is becoming apparent that the profit margins of many of the chemical majors could be improved as oil prices have been declining with great pace.

$1 = Rs. 64.37

Import Custom Ex. Rate USD/ INR: 65.10

Export Custom Ex. Rate USD/ INR: 63.40