Mixed Xylene Weekly Report 08 July 2017

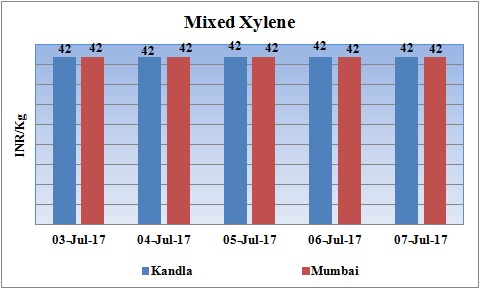

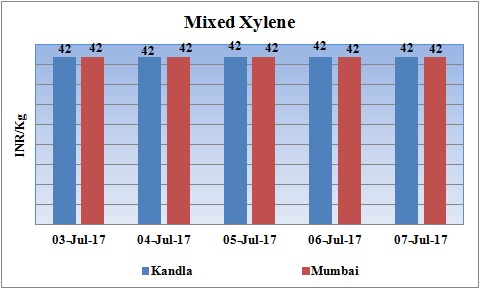

Weekly Price Trend: 03-07-2017 to 07-07-2017

- The above given graph focuses on the Mixed Xylene price trend for the current week.

- Domestic prices ofMixed Xylene remained unchanged for this week. Prices were assessed at the level of Rs.42/Kg for Kandla port and for Mumbai port.

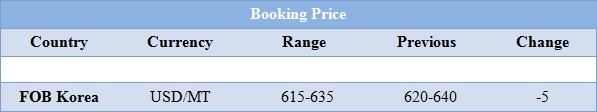

Booking Scenario

INDIA

- Mixed Xylene prices were assessed around Rs.42/Kg at Kandla port and for Mumbai port.

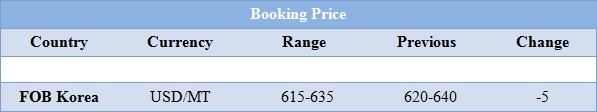

- International prices of Isomer grade Mixed Xylene decreased slightly for this week. Prices were assessed in the range of USD 615-635/MTS, reduced by USD 5/MTS in compare to last week’s closing values.

- CFR SE Asia prices were assessed in the range of USD 650/MT, decreased by USD 5/MTS in compare to last week’s assessed values.

- Para Xylene manufacturers of Asia have nominated the Asian contract prices for the month of July. Exxon Mobil has nominated ACP around USD 830/MT while apan's JX and South Korea's SK Global Chemical made theirs at $840/mt. Japan based Idemitsu Kosan has nominated prices for around USD 815/mt, reduced by down from its initial nomination of $900/mt last week.

- This week oil prices followed volatile trend. On Thursday oil prices closed on slightly higher note after a sharp but short-lived boost from a much bigger-than-expected decline in U.S. inventories of crude oil and gasoline. WTI on NYME closed at $45.52/bbl, prices have increased by $0.39/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.32/bbl in compared to last trading and was assessed around $48.11/bbl. Market players said the surge was driven by traders closing out short positions, or bets that oil prices would fall.

- There's a lot of bearishness out there now the market still believes supplies are not going to be in balance globally. Investors believe the OPEC will need to make further output cuts to offset thriving shale production in the United States.

- U.S. gasoline stocks dropped 3.7 million barrels in the most recent week, far exceeding the expected drop of 1.1 million barrels. Still, gasoline inventories remain about 6 percent above seasonal averages, so investors will watch for July data to see if demand is strong enough to whittle down stocks.

$1 = Rs. 64.59

Import Custom Ex. Rate USD/ INR: 65.65

Export Custom Ex. Rate USD/ INR: 63.95