Mixed Xylene Weekly Report 12 May 2018

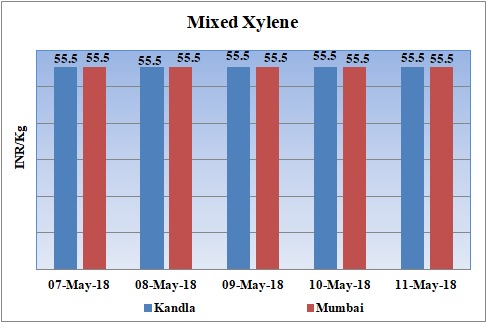

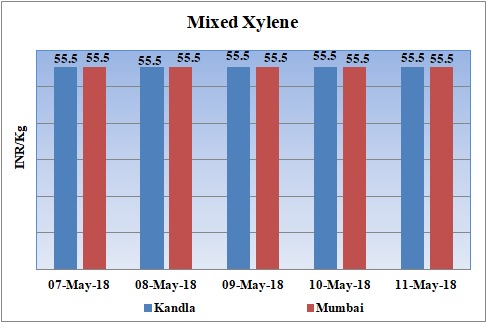

Weekly Price Trend: 07-05-2018 to 11-05-2018

- The above given graph focuses on the Mixed Xylene price trend for the current week.

- Domestic prices ofMixed Xylene remained firm for this week. Prices were assessed at the level of Rs.55.5/Kg for Mumbai port and for Kandla port.

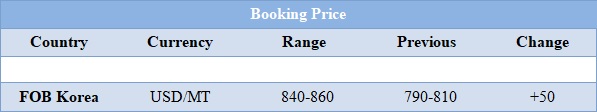

Booking Scenario

INDIA

- Mixed Xylene prices were assessed around Rs.55.5/Kg at Kandla port and for Mumbai port.

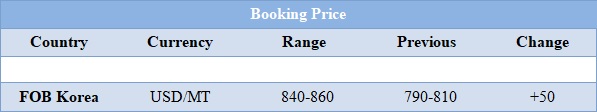

- International prices of Isomer grade Mixed Xylene increased for this week. Prices were assessed in the range of USD 840-860/MTS with an increase of USD 50/MTS in compares to last week’s closing values.

- CFR SEA values were assessed in the range of USD 860-880/MTS increased by USD 50/MTS in compare to last week’s closing values.

- In a major event US has decided that it will withdraw from the Iran nuclear deal and put powerful economic sanctions back into full effect. Energy-related sanctions take immediate effect for new business. But the Department of the Treasury will give businesses with existing contracts until November 4 to wind those trades down. Trump's plan to leave the Iran nuclear deal and re-impose sanctions could have major impacts for global oil, natural gas, metals and petrochemical markets.

- Many global companies have invested and have their major plans in the petrochemical industry of Iran. TOTAL, French petrochemical producer in July 2017 signed a deal with Iran's National Iranian Oil Co. to develop South Pars phase 11, which will have a production capacity of 2 Bcf/d (57 million cu m/d). Total has spent a little under $100 million on South Pars so far, according to a source close to the matter -- out of a potential $2 billion price tag for phase one of the project, which also involves China's CNPC and Iranian company Petropars.

- As per analysts oil prices to rise to $80-$100 per barrel later this year, once U.S. sanctions start to bite and Iran's exports start sinking. Market players said that OPEC will step up output in order to counter the Iran disruption."The market is now focused on OPEC and other producers' ability to react to this potential supply disruption,"

- "Investors are increasingly viewing Kuwait and Iraq as the producers with the best ability to raise output quickly in response to any fall in Iranian exports.

- Many experts believe that the United States will not be able to repeat the success it had last time it targeted Iran’s oil exports, when it knocked more than 1 million barrels a day out of the market. Most importantly, European and Asian countries that buy Iran’s oil aren’t enthusiastic about joining Washington in putting the squeeze on Tehran, because they see Iran as continuing to comply with the deal.

- By law, the United States must determine that the global oil market is well supplied before slapping sanctions on Iran’s oil exports — and that might be a tough argument to make with crude prices approaching four-year highs.

- This week with the little volatility oil prices have escalated sharply. On Thursday as traders adjusted to the prospects of renewed U.S. sanctions against major crude exporter Iran amid an already tightening market.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $69.06/bbl; prices have decreased by $1.67/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $1.32/bbl in compared to last trading and was assessed around $74.85/bbl.

$1 = Rs. 67.33

Import Custom Ex. Rate USD/ INR: 67.50

Export Custom Ex. Rate USD/ INR: 65.80