Mixed Xylene Weekly Report 13 May 2017

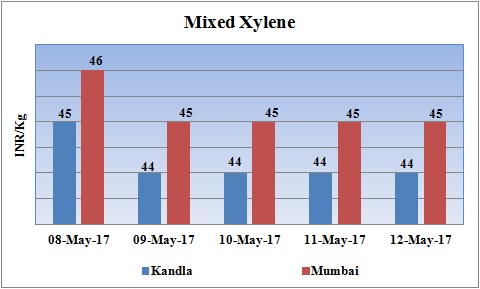

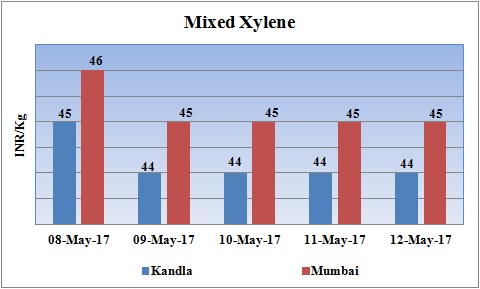

Weekly Price Trend: 08-05-2017 to 12-05-2017

- The above given graph focuses on the Mixed Xylene price trend for the current week.

- Domestic prices ofMixed Xylene remained soft for this week. Prices reduced significantly for this week. Prices were assessed at the level of Rs.44/Kg for Kandla port and Rs.45/Kg for Mumbai port.

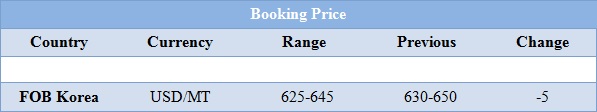

Booking Scenario

INDIA

- Mixed Xylene prices were assessed around Rs.46.5/Kg at Kandla port andRs.48/Kg for Mumbai port.

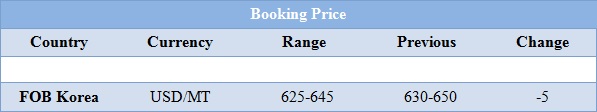

- International prices of Isomer grade Mixed Xylene declined significantly for this week. Prices were assessed in the range of USD 625-645/MTS, reduced by USD 5/MTS in compare to last week’s closing values.

- CFR SE Asia prices were assessed in the range of USD 655-675/MT, increased by USD 10/MTS in compare to last week’s assessed values.

- PTT Global Chemical is planning to shut its no2 para xylene plant for maintenance turnaround. The plant is likely to go off-stream in the mid of June. It is likely to remain off-stream for around 4 weeks. Unit is based at Rayong province in Thailand and has the manufacturing capacity of 765000 mt/year.

- The final agreement has been drafted between Jurong Aromatics and Exxon Mobil. The company will be acquire its Jurong based unit. This aromatic complex includes a 100,000 b/d condensate splitter, also has the capacity to produce 783,000 mt/year of jet fuel, 647,000 mt/year of light naphtha, 662,000 mt/year of gasoil, 283,000 mt/year of LPG, 35,000 mt/year of fuel oil, 46,000 mt/year of hydrogen and 18,000 mt/year of heavy aromatics, as well as petrochemical products including 800,000 mt/year of paraxylene, 400,000 mt/year of benzene and 200,000 mt/year of orthoxylene. Acquisition of the Jurong aromatics plant will increase ExxonMobil's Singapore aromatics production to over 3.5 million mt/year, of which 1.8 million mt is PX.

- India’s leading petrochemical refinery Reliance Industries Ltd has been one of the leading manufacturers of Par a Xylene in the world. With starting of new addition capacity of plant in December, TIL has become the second largest producer of Para Xylene in the world. Starting of 2.2mln mt/year unit in Jamnagar has escalated the total capacity to 4.2 mln mt/year. Company is now planning to enter in the ACP of chemical. It is in discussion with Hanwha Total of South Korea for Asian Contract Prices negotiations. According to traders and other ACP participants, the advantage the ACP settlement affords large producers is a guaranteed outlet for cargoes, while for buyers, stability of supply is afforded, at a fixed price.

- This week oil prices pushed up with minute plunge. Last week U.S. crude stockpiles posted their biggest drawdown since December as imports dropped sharply, while inventories of refined products also fell, helping boost oil prices that have been weighed down by concerns about oversupply.

- On Wednesday oil prices began looking higher after a string of positive data on oil stocks in the US helped to improve the market mood.

- As per reports, drop in the prices was seen which was beyond expectation and fuel stocks received the initial bullish attention. Adding to the positive tone was the reduction in imports.

- According to report a large part of the excess supply extended which in turn led to the shortage in the storage facilities.

- However, continued rebalancing in the oil market by year-end will require the collective efforts of all oil producers to increase market stability, not only for the benefit of the individual countries, but also for the general prosperity of the world economy, As per report.

- OPEC is due to meet later this month in the hope of striking a second deal to secure a year of production cuts. The twelve member states will be joined by Russia, but US production remains a concern.

- On Thursday, closing crude values have increased.WTI on NYME closed at $47.83/bbl, prices have increased by $0.50/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.55/bbl in compared to last trading and was assessed around $50.77/bbl.

$1 = Rs. 64.30

Import Custom Ex. Rate USD/ INR: 65.10

Export Custom Ex. Rate USD/ INR: 63.40