Mixed Xylene Weekly Report 22 July 2017

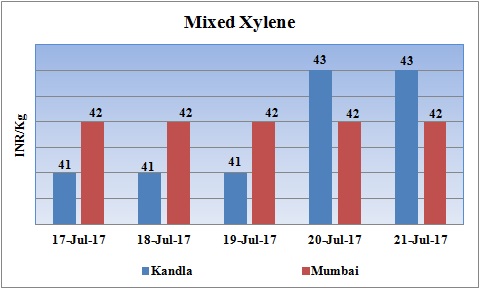

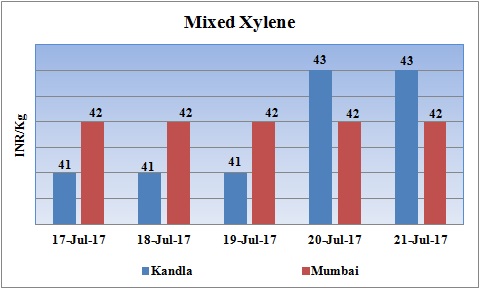

Weekly Price Trend: 17-07-2017 to 21-07-2017

- The above given graph focuses on the Mixed Xylene price trend for the current week.

- Domestic prices ofMixed Xylene reduced for this week. Prices were assessed at the level of Rs.42/Kg for Mumbai port and Rs.43/Kg for Kandla port.

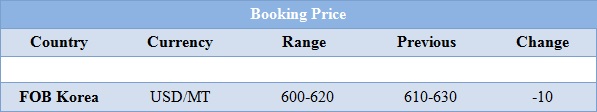

Booking Scenario

INDIA

- Mixed Xylene prices were assessed around Rs.41/Kg at Kandla port and Rs42/Kg for Mumbai port.

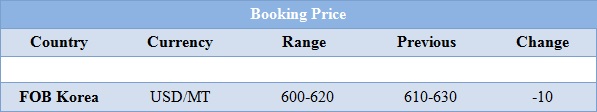

- International prices of Isomer grade Mixed Xylene decreased slightly for this week. Prices were assessed in the range of USD 600-620/MTS, reduced by USD 10/MTS in compare to last week’s closing values.

- CFR SE Asia prices were assessed in the range of USD 630/MT, decreased by USD 10/MTS in compare to last week’s assessed values.

- Hanwha Total has shut down its naphtha cracker due to power outages caused by a lightning strike. It happened in afternoon with no causalities being reported. The lightning strike happened in the afternoon at its plant in Daesan, some 130 kilometres (about 81 miles) southwest of Seoul, a company spokesman said. It was unclear when the 1 million tpa naphtha cracker would restart.

- This week oil prices have followed volatile trend in the market. Oil prices jumped more than 1 percent on Wednesday after a U.S. report showed a bigger weekly draw than forecast in crude and gasoline stocks along with a surprise drop in distillate inventories.

- On Thursday, oil settled lower in uneven trading. Closing crude values have decreased.WTI on NYME closed at $46.92/bbl, prices have decreased by $0.40/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.40/bbl in compared to last trading and was assessed around $49.30/bbl.

- Russia is ready to continue working with OPEC to help rebalance oil markets, Moscow welcomed a flexible approach by OPEC's leader Saudi Arabia to accommodate rising output from Nigeria and Libya, said by source.

- Market players predicted that prices would hold near current levels ahead of Monday's meeting between key OPEC and non-OPEC producers in St. Petersburg, Russia. The market has been watching reports that Saudi Arabia, the world's largest crude producer, is considering an additional supply cut to reduce the global glut.

$1 = Rs. 64.32

Import Custom Ex. Rate USD/ INR: 65.65

Export Custom Ex. Rate USD/ INR: 63.95