Mixed Xylene Weekly Report 25 August 2018

Weekly Price Trend: 20-08-2018 to 24-08-2018

- The above given graph focuses on the Mixed Xylene price trend for the current week.

- Domestic prices ofMixed Xylene remained firm for this week. Prices were assessed at the level of Rs.64/Kg for Mumbai and Rs.63/Kg for Kandla port.

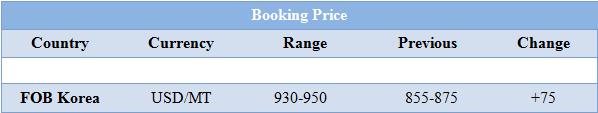

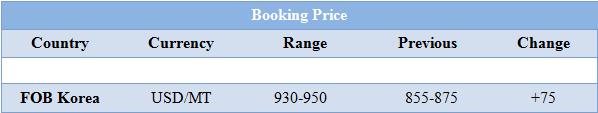

Booking Scenario

INDIA

- Mixed Xylene prices were assessed around Rs.64/Kg at Kandla port and Rs.63/Kg for Mumbai port.

- International prices of Isomer grade Mixed Xylene increased heavily for this week. Prices were assessed in the range of USD 930-950 increased by USD75/MT in compares to last week’s closing values.

- CFR SEA values were assessed in the range of USD 955/MTS increased by USD 20/MTS in compare to last week’s closing values.

- The US-China trade war escalated as a new round of tariffs affecting $16bn worth of imports, including petrochemicals, took effect at midday in Asia on Thursday, raising the total value of affected goods to $50bn on each side. The second wave of US tariffs on Chinese imports is being implemented less than two months since the first salvo on 6 July, and just as trade negotiations between the two countries were revived in Washington.

- In a statement issued on Thursday noon, China’s Ministry of Commerce said that the US move is a violation of World Trade Organisation (WTO) rules.

- “China firmly opposes this and has to continue to make the necessary counterattack," it said.

The scheduled 22-23 August meeting between US treasury undersecretary for international affairs David Malpass and Chinese vice commerce minister Wang Shouwen initially raised hopes of a resolution to the ongoing trade spat between the world’s two biggest economies.

- This week oil prices have followed volatile trend. On Thursday oil prices plunged as an swelling trade dispute between the United States and China balanced news of a decline in U.S. commercial crude inventories.

- On Thursday, closing crude values have decreased. WTI on NYME closed at $67.83/bbl. Prices have decreased by $0.03/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.05/bbl in compare to last closing price and was assessed around $74.73/bbl.

- Oil demand is closely linked to economic activity and the trade dispute has already led analysts to trim their forecasts for future energy consumption. But while the outlook for oil demand growth may be moderating, some markets are tight. As per report, this week's report was bullish for crude. Crude stocks drew due to sharply lower crude imports and near-record refinery crude runs.

$1 = Rs. 69.91

Import Custom Ex. Rate USD/ INR: 71.10

Export Custom Ex. Rate USD/ INR: 69.40