Mixed Xylene Weekly Report 30 June 2018

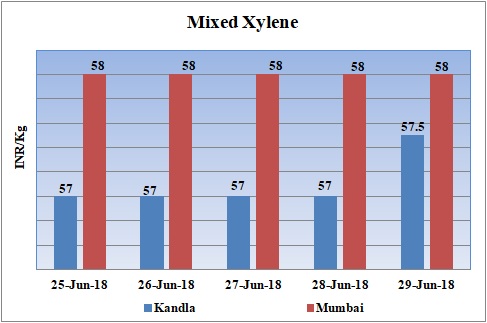

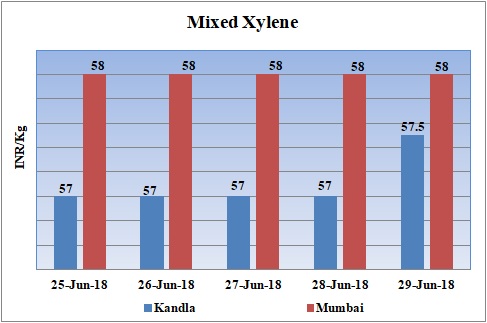

Weekly Price Trend: 25-06-2018 to 29-08-2018

- The above given graph focuses on the Mixed Xylene price trend for the current week.

- Domestic prices ofMixed Xylene remained weak for this week. Prices were assessed at the level of Rs.58/Kg for Mumbai and Rs.57.5/Kg for Kandla port.

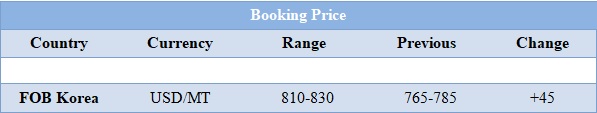

Booking Scenario

INDIA

- Mixed Xylene prices were assessed around Rs.58/Kg at Kandla port and Rs. 57.5/Kg for Mumbai port.

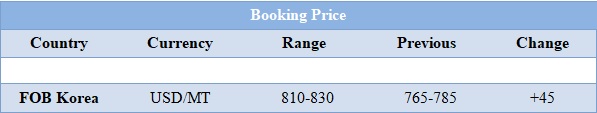

- International prices of Isomer grade Mixed Xylene regained the loss of last week. Prices were assessed in the range of USD 810-830 increased by USD 45/MTS in compares to last week’s closing values.

- CFR SEA values were assessed in the range of USD 825-845/MTS increased by USD 45/MTS in compare to last week’s closing values.

- Japan based Idemitsu Kosan has nominated its Asian Contract prices for the month of July. The prices nominated are around around USD 1090/MT, reduced by USD 30/MT incompare to last week’s nomination.

- The lowest nomination so far is ExxonMobil's at $1,030/mt, followed by South Korea's SK Global Chemical at $1,040/mt, and both Japan's JXTG Nippon Oil & Energy, and, South Korea's S-Oil, at $1,100/mt.

- There are five PX ACP sellers in Asia: JXTG Nippon Oil & Energy, Idemitsu Kosan, S-Oil, SK Global Chemical, and ExxonMobil.

- China based has announced its June settlement prices for Para Xylene. The contract prices were reduced by 290 Yuan in compare to last month. The prices were settled around USD 940/MT. This low settlement indicates that market has become very favorable for buyers point of view.

- The melt down of Indian currency to its lowest level in this week will put oil prices under great pressure for India. Moreover under pressure of US, Indian government has issued to its oil companies to not to make any oil purchase from Iran will further increase the fuel prices in the country. The next week is likely to witness significant bump in fuel prices as well as petchem prices.

- This week crude oil prices have increased heavily. On Thursday oil prices climbed, with U.S. crude hitting a three-and-a-half year high, bolstered by supply concerns due to U.S. sanctions that could cause a large drop in crude exports from Iran.

- On Thursday, closing crude values have increased. WTI on NYME closed at $73.45/bbl; prices have increased by $0.69/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.23/bbl in compare to last closing price and was assessed around $77.85/bbl.

- On Friday, oil prices dipped amid escalating trade friction between the United States and other major economies, although crude markets remain tight due to supply disruptions and generally high demand.

- As per market report, oil prices have rallied for much of 2018 on tightening market conditions due to record demand and voluntary supply cuts led by OPEC and other producers including Russia. Unplanned supply disruptions from Canada to Libya and Venezuela also have supported prices.

- OPEC plus meetings was that those countries with spare capacity would increase production to keep the market well-supplied."an incremental 1 million bpd from this group is feasible in July" and that this would offset the expected drop in Iranian exports and other declines elsewhere during the second-half of the year.

$1 = Rs. 68.47

Import Custom Ex. Rate USD/ INR: 69.10

Export Custom Ex. Rate USD/ INR: 67.40