N-Butanol Weekly Report 28 April 2018

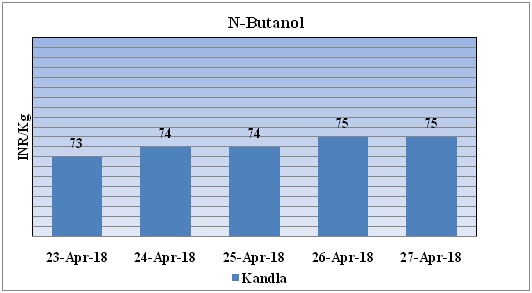

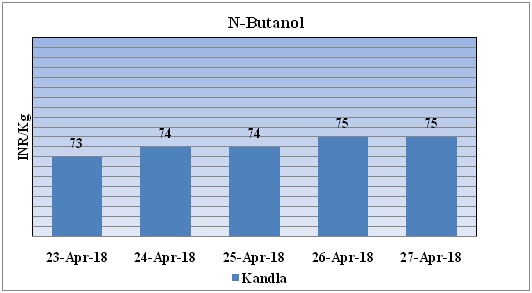

Weekly Price Trend: 23-04-2018 to 27-04-2018

- The above given graph focuses on the N-Butanol price trend for the current week.

- If we take a quick look at the above given weekly prices then it can be observed that the prices of N-Butanol have increased this week in compares to previous week and at the end of this week prices were assessed at the level of Rs. 75/Kg at Kandla port.

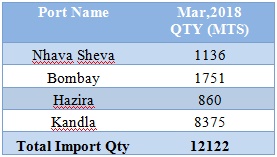

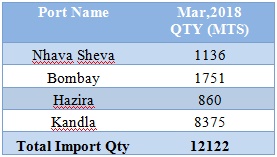

Total import at various ports of India March, 2018

Above chart represents the total imported quantity of N-Butanol for the month of March, 2018.

Last month total imports were around 12122MT.

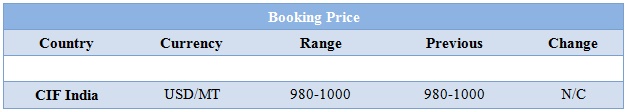

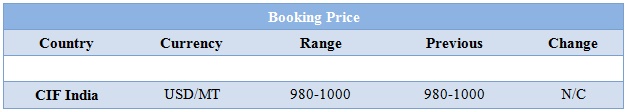

Booking Scenario

The prices of N-Butanol are also affected by duties that are there for different countries. For example, there is 7.5% duty on South Africa and the Europe Zone. And there is 2.5% duty on Malaysia. These prices are for full duty (7.5%) for US, Europe region.

INDIA & INTERNATIONAL

- This week domestic prices of N-Butanol have increased and were assessed at Rs. 75/Kg for Kandla port.

- This week international market prices have remained firm.

- This week N-Butanol market has remained soft on bearish demand.

- This week feedstock propylene prices have decreased.

- South East Asia prices of feedstock propylene were assessed at USD 960/mt.

- CFR China prices of propylene were evaluated at USD 1085/mt.

- FOB Korea prices of propylene were evaluated at USD 1045/mt.

- This week oil prices have followed little volatility at the end of the week prices have escalated. On Thursday oil prices increased, supported by expectations of renewed U.S. sanctions on Iran, declining output in Venezuela and ongoing strong demand.

- On Thursday, closing crude values have increased. WTI on NYME closed at $68.19/bbl; prices have increased by $0.14/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.74/bbl in compared to last trading and was assessed around $74.74/bbl.

- Venezuela's plunging output and looming U.S. sanctions against Iran come against a backdrop of strong demand, especially in Asia, the world's biggest oil consuming region. However, not all market indicators point towards tighter supplies. Soaring U.S. oil production and exports are holding back further price gains.

$1 = Rs. 66.66

Import Custom Ex. Rate USD/ INR: 66.70

Export Custom Ex. Rate USD/ INR: 65.00