N-Butanol Weekly Report 30 June 2018

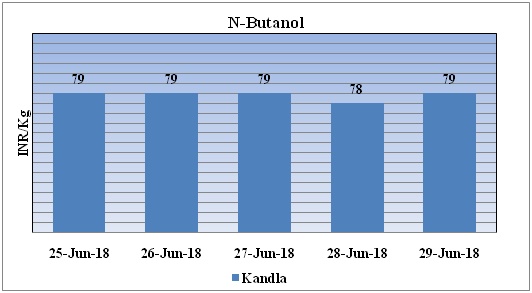

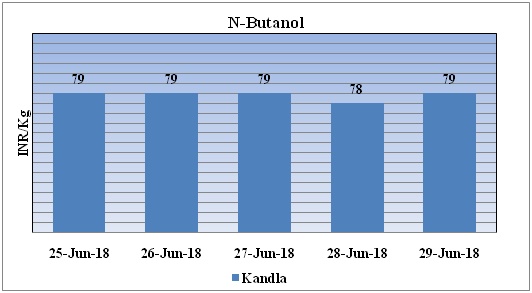

Weekly Price Trend: 25-06-2018 to 29-06-2018

- The above given graph focuses on the N-Butanol price trend for the current week.

- If we take a quick look at the above given weekly prices then it can be observed that the prices of N-Butanol have fluctuated little this week in compares to previous week and at the end of this week prices were assessed at the level of Rs. 79/Kg at Kandla port.

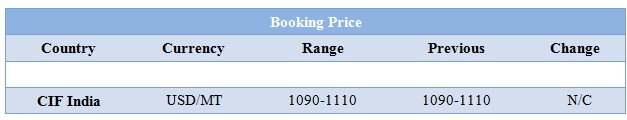

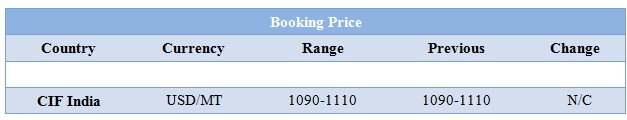

Booking Scenario

The prices of N-Butanol are also affected by duties that are there for different countries. For example, there is 7.5% duty on South Africa and the Europe Zone. And there is 2.5% duty on Malaysia. These prices are for full duty (7.5%) for US, Europe region.

INDIA & INTERNATIONAL

- This week domestic prices of N-Butanol have remained volatile and were assessed at Rs.79/Kg for Kandla port.

- This week International N-Butanol prices have remained firm on sluggish demand trend.

- South East Asia prices of feedstock propylene were assessed at USD 1010/mt.

- CFR China prices of propylene were evaluated at USD 1080/mt.

- FOB Korea prices of propylene were evaluated at USD 1045/mt.

- China’s Yankuang Cathay to restart its N-butanol plant having the capacity of 150000 MT per year it is placed at Tengzhou, Shandong, China.

- PetroChina Sichuan Petrochemical restarts its N-Butanol plant.

- European petrochemicals producer Ineos has declared a force majeure on N-Butanol production at its 330,000 mt/year N-Butanol plant in Lavera, France. The FM was declared due to problem in one of the plant's compressors. The issue will be sorted out soon and force majeure will be lifted by end of July.

- This week crude oil prices have escalated. On Thursday oil prices climbed, with U.S. crude hitting a three-and-a-half year high, bolstered by supply concerns due to U.S. sanctions that could cause a large drop in crude exports from Iran.

- On Thursday, closing crude values have increased. WTI on NYME closed at $73.45/bbl; prices have increased by $0.69/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.23/bbl in compare to last closing price and was assessed around $77.85/bbl.

- As per market report, oil prices have rallied for much of 2018 on tightening market conditions due to record demand and voluntary supply cuts led by OPEC and other producers including Russia. Unplanned supply disruptions from Canada to Libya and Venezuela also have supported prices.

- OPEC plus meetings was that those countries with spare capacity would increase production to keep the market well-supplied."an incremental 1 million bpd from this group is feasible in July" and that this would offset the expected drop in Iranian exports and other declines elsewhere during the second-half of the year.

$1 = Rs. 68.47

Import Custom Ex. Rate USD/ INR: 69.10

Export Custom Ex. Rate USD/ INR: 67.40