N Hexane Weekly Report 26 Aug 2017

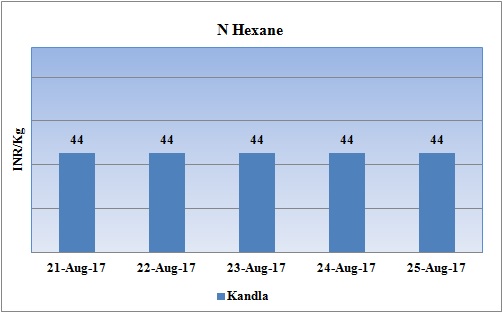

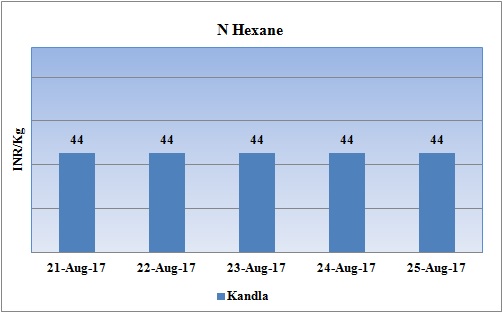

Weekly Price Trend: 21-08-2017 to 25-08-2017

- The above given graph focuses on the N Hexane price trend for the current week.

- Prices were assessed at the level of Rs.44/Kg in this week, with no change in compare to last week’s closing values.

- By end of the week prices were assessed around Rs.44/Kg for bulk quantity.

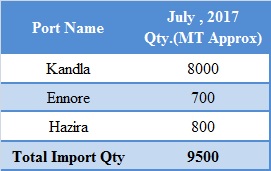

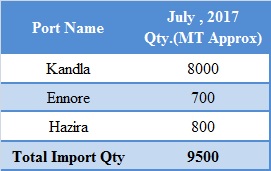

Total import at various ports in the month of July 2017

The above chart depicts the import of N Hexane at various ports of India in the month of July 2017.

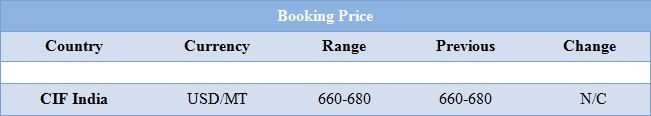

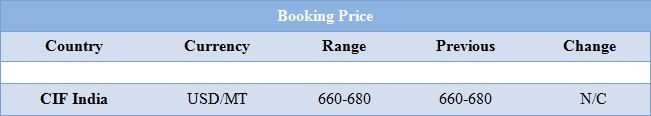

Booking Scenario

INDIA& INTERNATIONAL

- This week N hexane prices reduced slightly in domestic market. Prices were assessed around Rs.44/Kg for bulk quantity.

- Prices in international market remained unchanged for this week. CIF India prices of N Hexane were assessed at the level of USD 660-680/MTS, with no change in compare to last week’s assessed values.

- This week crude oil prices have remained volatile. On Friday, oil prices rose as the U.S. petroleum industry prepared for potential output disruptions as Hurricane Harvey headed for the heart of the nation’s oil industry in the Gulf of Mexico. The storm has rapidly intensified since Thursday while On Thursday closing crude values have decreased.WTI on NYME closed at $47.43/bbl, prices have decreased by $0.98/bbl in compared to last closing prices. While Brent on Inter Continental Exchange decreased by $0.53/bbl in compared to last trading and was assessed around $52.04/bbl.

- As per report, Prices rose as production in the affected area shut down in preparation for the hurricane, and on expectations that closures could last if the storm causes extensive damage.

- Market players have said that traders expect more upward pressure as the storm gets closer to Texas. Oil prices, however, fell because refiners may use less supply due to the storm.

- It is anticipated that recently oil prices to trade higher on account of support coming from inventory withdrawals in the US. However, Libya’s rising output remains a cause of concern for oil markets.

$1 = Rs. 64.03

Import Custom Ex. Rate USD/INR: Rs. 65.15

Export Custom Ex. Rate USD/INR: Rs. 63.45