Phenol Weekly Report 11 Feb 2017

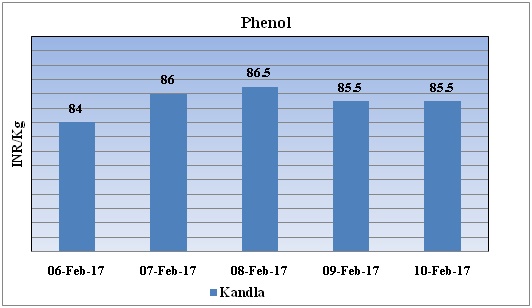

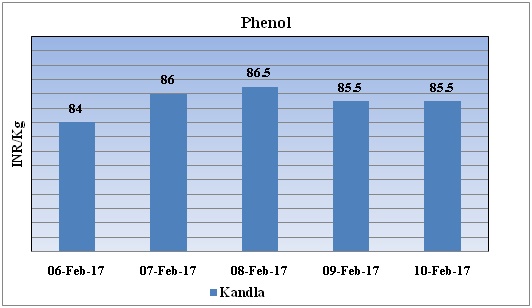

Weekly Price Trend: 06-02-2017 to 10-02-2017

- The above given graph focuses on the Phenol price trend for the current week.

- If we take a quick look at the above given weekly price trend it can be observed that this week domestic market prices of Phenol have fluctuated and at the end of the week were assessed at the level of Rs. 85.5/Kg for bulk quantity.

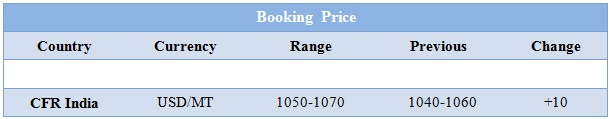

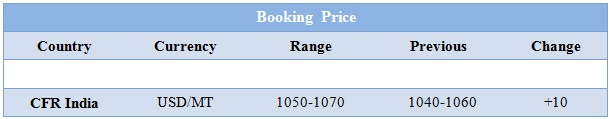

Booking Scenario

INDIA & INTERNATIONAL

- This week domestic market prices were assessed around Rs.81/Kg for bulk quantity. Prices have increased.

- CFR India prices for this week were assessed in the range of USD 1050-1060/MTS, prices have increased in compared to last assessed values.

- Presently phenol demand is escalating on account of this booking prices have escalated.

- Phenol prices into India may extend gains after reaching a 21-month high as supply tightens up amid escalating raw material benzene prices, market participants said.

- Phenol stockpiles at Kandla plunged to 24,000-25,000 tonnes from around 29,000 tonnes the week prior.

- South Korean producer Kumho P&B has had to shut down its two operational phenol/acetone units because of a mechanical problem that occurred.

- Crude oil prices have followed fluctuation through the week and at end of the week prices have increased after an unexpected draw in U.S. gasoline inventories pointed to higher demand in the world's biggest oil market.

- As per report U.S. commercial crude inventories rose, high fuel inventories and rising U.S. crude production meant oil markets would be over-supplied for some time, but that they would drain gradually, while the rest of the world already showing signs of tightness.

- The crude oil inventory build was really terrible for the market but the market does not seem to care because the products inventories were better than expected and are dragging crude oil prices up with it.

- Market Analysts said that in near term prices could be volatile as higher U.S. crude supplies balanced output cuts by the OPEC and other producing nations. Recently oil is in a very dangerous zone because market is moving with bearish velocity.

- On Thursday, closing crude values have increased.WTI on NYME closed at $53.00/bbl, prices have increased by $0.66/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.51/bbl in compared to last trading and was assessed around $55.63/bbl.

- Feedstock benzene prices have increased.

- FOB Korea and CFR China prices of Benzene were evaluated at USD 1030/mt and USD 1045/mt respectively.

$1 = Rs. 66.88

Import Custom Ex. Rate USD/ INR: 68.40

Export Custom Ex. Rate USD/ INR: 66.70