Phthalic Anhydride Weekly Report 30 Dec 2017

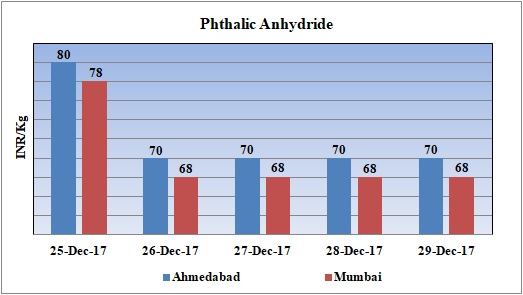

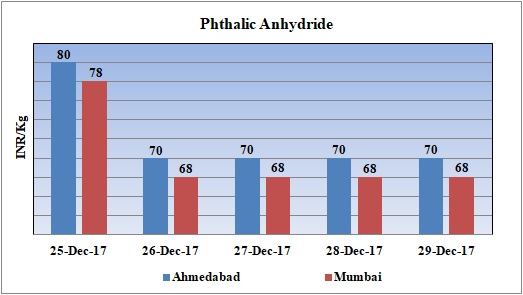

Weekly Price Trend: 25-12-2017 to 29-12-2017

- The above given graph focuses on the Phthalic Anhydride price trend for current week.

- There has been significant fall in domestic prices for this week. Prices were assessed around Rs.70/Kg for Ahmedabad and Rs 68/Kg for Mumbai port.

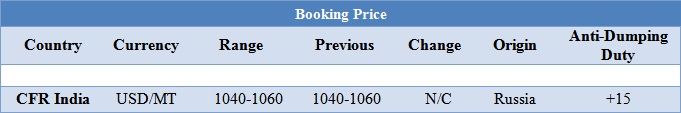

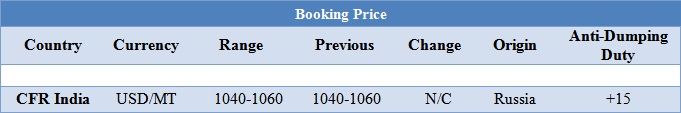

Booking Scenario

Antidumping Duty Country-wise

Israel-USD 139.76/MT Taiwan-USD150.88/MT Korea-USD91.12/MT.

The above chart shows the international prices of Phthalic Anhydride and its comparison from the previous prices.

INDIA & INTERNATIONAL

- Domestic prices were assessed in the range of 70/Kg for Ahmedabad and Rs 68/Kg for Mumbai port. This week there has heavy slowdown in domestic values. CFR India Phthalic Anhydride prices were assessed at the level of USD 1040-1060/MT.

- Indian government has taken an important decision of extending its anti dumping duty on imports of Phthalic Anhydride from three countries which are Korea RP, Chinese Taipei and Israel. Earlier this duty was imposed in the year 2012. The government has decided to extend this duty now till 24 December 2018. By the mean time investigation will continue to sort out the matter.

This week crude oil prices have remained fluctuating. As 2017 draws to a close, On Thursday oil prices increased on lifted by strong data from top importer China and on increased U.S. refining activity that drew more crude from inventories. Recently, thin trading activity ahead of the New Year weekend.

As per report, market condition has been tight due to ongoing supply cuts led by OPEC, as well as top producer Russia.

On Thursday, closing crude values have increased. WTI on NYME closed at $59.84/bbl; prices have increased by $0.20/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.28/bbl in compared to last trading and was assessed around $66.72/bbl.

As per market analyst, In the first half of 2018, market will remain quite bullish as Saudi Arabia continues to signal its intent to privatize part of Saudi Aramco, the state-owned oil company, in an initial public offering expected in late 2018. As such, the Saudis will be quite motivated to keep prices up going into that sale. The risk to that outlook could become apparent if Russia stops cooperating, which has been a significant tipping factor in the cuts' effectiveness.

$1 = Rs. 63.87

Import Custom Ex. Rate USD/ INR: 64.90

Export Custom Ex. Rate USD/ INR: 63.20