Toluene Weekly Report 01 July 2017

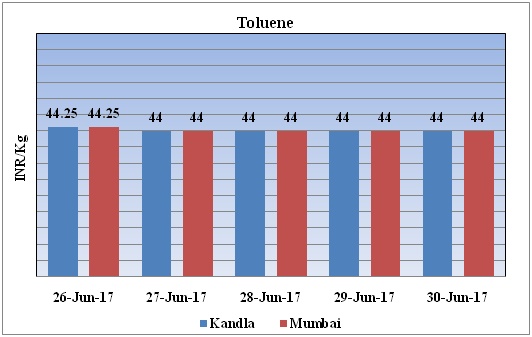

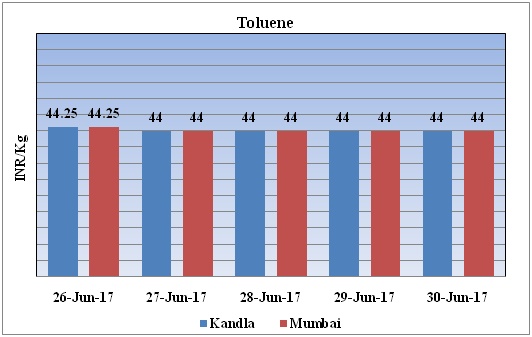

Weekly Price Trend: 26-06-2017 to 30-06-2017

- The above given graph focuses on the Toluene price trend for current week.

- This week prices have followed volatile trend. By the end of the week domestic prices were assessed at Rs 44/Kg for bulk quantity for Kandla and Mumbai ports of India.

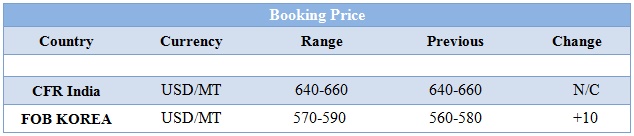

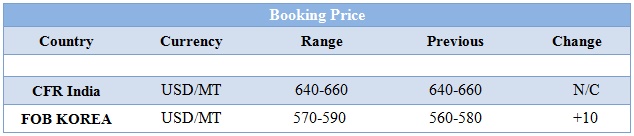

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market price was assessed at Rs 44/kg for Kandla and Rs. 44/kg for Mumbai ports of India.

- CFR India prices were evaluated at USD 650/mt, prices have remained firm in compares to previous week.

- CFR China price of toluene were assessed at the level of USD 605/mt.

- FOB Korea prices were evaluated at USD 580/mt prices has increased minutelyin compare to previous week.

- East China toluene market muted amid wide buy-sell gap.

- Europe toluene market expects decrease for upcoming July contract settlement.

- As per data analysis, on account of sluggish demand toluene toluene imports in the first half of 2017 decreased on annual basis, and the number of new capacity was not large.

- As per report, the growth of toluene consumption in coastal regions is probable to slow down, as Shandong Hongrun Petrochemical, CNOOC Huizhou Refinery and PetroChina Yunnan plan to start their aromatics complexes in the latter half year.

- As per analysis market predictors it is anticipated that in near term toluene demand sentiments will remain sluggish.

- Crude oil prices have followed positive inclination as the fall in U.S. production has bolstered markets this week.

- On Thursday, closing crude values have increased.WTI on NYME closed at $44.93/bbl, prices have increased by $0.19bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.11/bbl in compared to last trading and was assessed around $47.42/bbl.

- After the steep drop in oil prices of recent weeks, market players said that especially hedge funds saw nice buying momentum and lower U.S. crude production was the trigger to act.

- U.S. crude output dropped 100,000 barrels per day (bpd) to 9.3 million bpd last week, the steepest weekly fall since July 2016.

$1 = Rs. 64.58

Import Custom Ex. Rate USD/ INR: 65.15

Export Custom Ex. Rate USD/ INR: 63.50