Toluene Weekly Report 01 Sep 2018

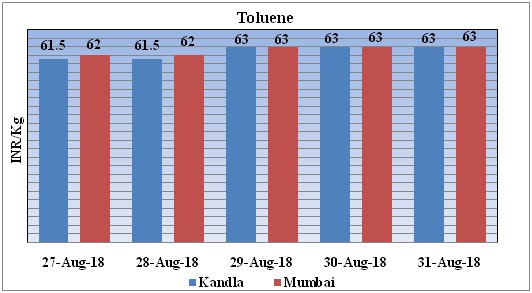

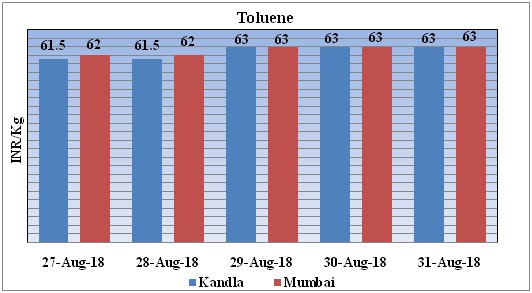

Weekly Price Trend: 27-08-2018 to 31-08-2018

- The above given graph focuses on the Toluene price trend for current week.

- This week prices have increased. By the end of the week domestic prices were assessed at Rs 63/Kg for bulk quantity for Kandla and Rs 63/kg for Mumbai ports of India.

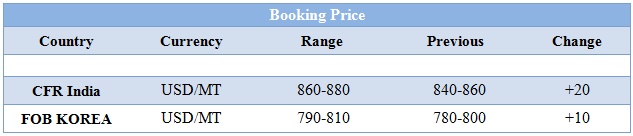

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market price was assessed at Rs 63/kg for Kandla and Rs.63/kg for Mumbai ports of India.

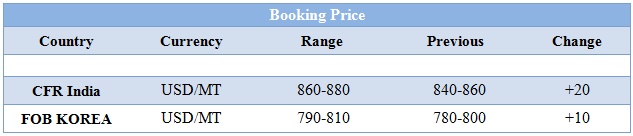

- CFR India prices were evaluated at USD 870/mt, prices have increased in compares to previous week.

- This week Toluene prices have increased on account of bullish demand sentiments from end users.

- CFR China price of toluene were assessed at the level of USD 815/mt.

- FOB Korea prices were evaluated at USD 800/mt prices has increased in compare to previous week.

- CFR south East Asia price were evaluated at USD 840/mt.

- Aromatic production in South Korea and Japan remained unaffected largely due to closure of ports by typhoon Soulik and Cimaron. The strong strong winds and the heavy rain accompanying Typhoon Soulik have forced the closure of Daesan, Ulsan, Incheon and Yosu ports in South Korea, company sources at Hanwha Total, GS Caltex and SK Global Chemical confirmed Friday."Of course, the temporary shutdown of the ports throws out the delivery schedule of not just petrochemicals, but also upstream products like heavy naphtha," a producer source at one of the impacted ports said. The ports are expected to reopen by the end of Friday.

- This week oil prices have followed volatile trend. On Thursday oil prices increased due to extending gains on growing evidence of disruptions to crude supply from Iran and Venezuela and after a fall in U.S. crude inventories.

- On Thursday, closing crude values have increased. WTI on NYME closed at $70.25/bbl. Prices have increased by $0.74/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.63/bbl in compare to last closing price and was assessed around $77.77/bbl.

- Brent has risen by almost 10 percent over the past two weeks on widespread perceptions that the global oil market is tightening and could run short in the next few months as U.S. sanctions restrict crude exports from Iran.

- Market players have said that market will remain tight towards the end of the year because of falling supply in countries such as Iran and Venezuela combined with strong demand, especially in Asia.

$1 = Rs. 70.99

Import Custom Ex. Rate USD/ INR: 71.10

Export Custom Ex. Rate USD/ INR: 69.40