Toluene Weekly Report 13 May 2017

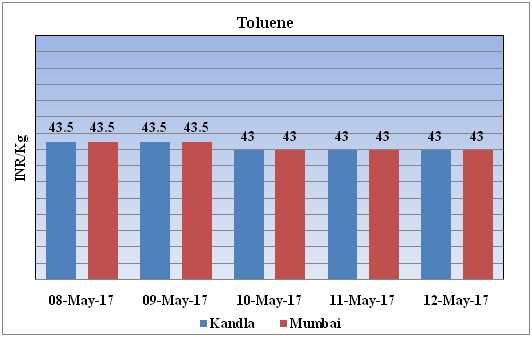

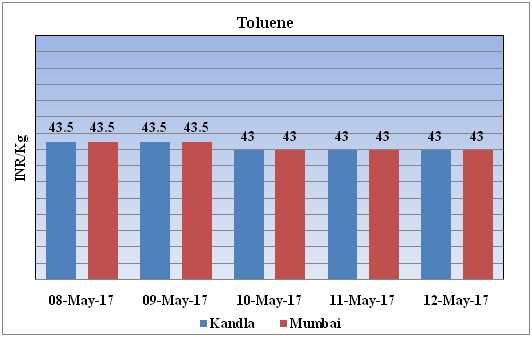

Weekly Price Trend: 08-05-2017 to 12-05-2017

- The above given graph focuses on the Toluene price trend for current week.

- This week prices have followed weak trend. By the end of the week domestic prices were assessed Rs 43/Kg for bulk quantity for Kandla and Rs.43/kg for bulk quantity for Mumbai ports of India.

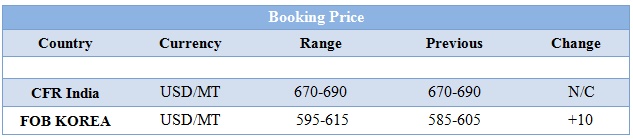

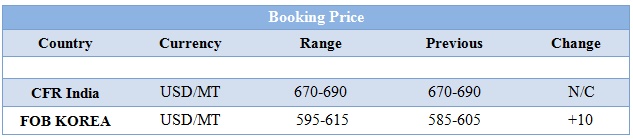

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market price was assessed at Rs 43/kg for Kandla and Rs. 43/kg for Mumbai ports of India.

- CFR India prices were evaluated at USD 680/mt, prices have remained firm in compares to previous week.

- CFR China price of toluene were assessed at the level of USD 628/mt.

- FOB Korea prices were evaluated at USD 605/mt prices has increasedin compare to previous week.

- FOB Korea and CFR China prices of Benzene were evaluated at USD 720/mt and USD 735/mt respectively.

- Presently toluene market is moving with downward velocity.

- East China toluene price has declined on higher supply.

- Presently, toluene market is under pressure, in the lack of momentum.

- Large supply availability brings pressure on the toluene market.

- China’s toluene facilities that underwent turnaround in Mar-Apr are mostly going to restart in month of May.

- Toluene supply and demand fundamentals have been bearish sentiment. Toluene market is dubious to upward and some market players suggested to look upon the oil prices progress.

- This week oil prices have followed up inclination with minute plunge. Last week U.S. crude stockpiles posted their biggest drawdown since December as imports dropped sharply, while inventories of refined products also fell, helping boost oil prices that have been weighed down by concerns about oversupply.

- According to report a large part of the excess supply overhang contained in floating storage facilities has been reduced and the improvement in the world economy will help support oil demand too.

- However, continued rebalancing in the oil market by year-end will require the collective efforts of all oil producers to increase market stability, not only for the benefit of the individual countries, but also for the general prosperity of the world economy, As per report.

- Opec is due to meet later this month in the hope of striking a second deal to secure a year of production cuts. The twelve member states will be joined by Russia, but US production remains a concern.

- On Thursday, closing crude values have increased.WTI on NYME closed at $47.83/bbl, prices have increased by $0.50/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.55/bbl in compared to last trading and was assessed around $50.77/bbl.

$1 = Rs. 64.30

Import Custom Ex. Rate USD/ INR: 65.10

Export Custom Ex. Rate USD/ INR: 63.40