Toluene Weekly Report 15 Sep 2018

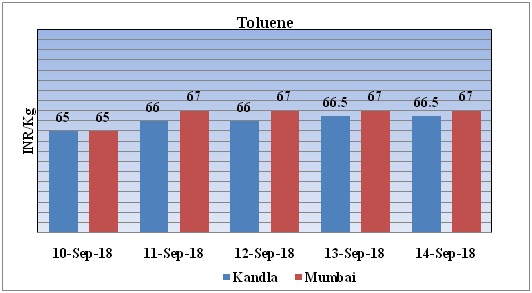

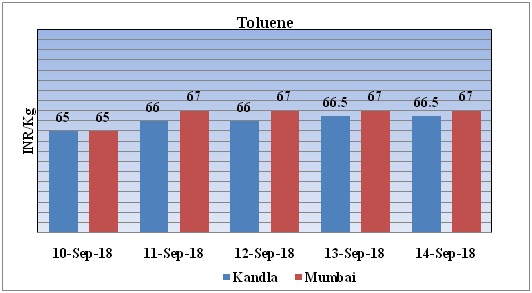

Weekly Price Trend: 10-09-2018 to 14-09-2018

- The above given graph focuses on the Toluene price trend for current week.

- This week prices have increased. By the end of the week domestic prices were assessed at Rs 66.5/Kg for bulk quantity for Kandla and Rs 67/kg for Mumbai ports of India.

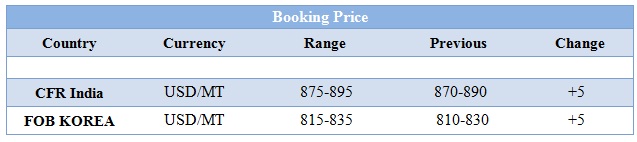

Booking Scenario

INDIA&INTERNATIONAL

- This week domestic market price was assessed at Rs 66.5/kg for Kandla and Rs.67/kg for Mumbai ports of India.

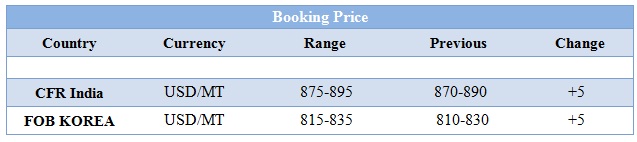

- CFR India prices were evaluated at USD 880/mt, prices have remained firm in compares to previous week.

- CFR China price of toluene were assessed at the level of USD 860/mt.

- FOB Korea prices were evaluated at USD 825/mt prices has increased in compare to previous week.

- CFR south East Asia price were evaluated at USD 860/mt.

- This week Toluene prices have increased as East China toluene port inventories fall by 23.3%.

- European toluene market is moving with balanced pace as supply available in ample amount.

- As per market report, some plants are going to shut for maintenance turnarounds and several plants are going to start in Europe through September and October.

- A sudden rash of offers in the market has caught several traders and consumers by surprise when it had looked "super tight”. As per market report, last month, looking to September players was a bit worried about supply because of a lot of turnarounds going on in the European market. But as per current situation, for volume there are not any issues to get it.

- A more balanced market had been expected with the restart of BASF's toluene di-isocyanate (TDI) plant. But there is another TDI plant believed to be doing maintenance work. Source said that demand will outstrip supply, especially in the TDI grade as a result of the restart of BASF plant.

- Oil prices crossed the levels of USD80 by mid of the week, later it fell by more than 2% on Thursday. This hike was the highest in last four months. The international Energy Agency has already warned that the oil market is tightening at the moment and world oil demand would soon reach 100 million barrels per day (bpd) in the next three months, global economic risks were mounting.

- U.S. companies in China are being hurt by tariffs in the growing trade war between Washington and Beijing, according to a survey, prompting U.S. business lobbies to urge President Donald Trump's administration to reconsider its approach.

- The White House has invited Chinese officials to restart trade talks just as it prepares to escalate a trade war with China with tariffs on $200 billion worth of Chinese goods.

- The other major factor is the loss of Iranian oil to the market as refiners are cutting or halting purchase ahead of U.S. sanctions in November is also raising concerns about supply.

- All these factor has put an rigorous pressure on petrochemical industry and has led to hike in the prices of crucial petrochemical products.

$1 = Rs. 71.84

Import Custom Ex. Rate USD/ INR: 72.55

Export Custom Ex. Rate USD/ INR: 70.85