Vinyl Acetate Monomer Weekly Report 06 Jan 2018

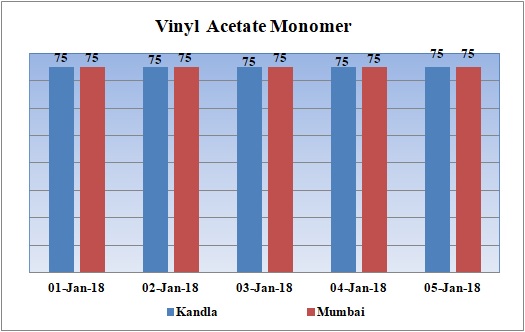

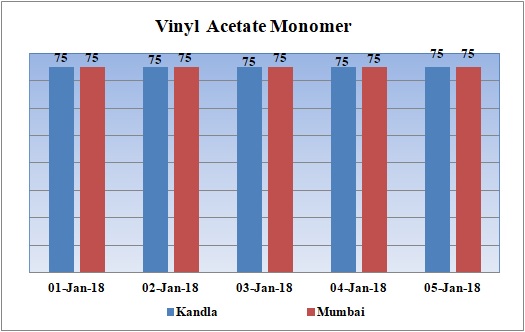

Weekly Price Trend: 01-01-2018 to 05-01-2018

- The graph above focuses on the Vinyl Acetate Monomer price trend for the current week.

- There has been no changes in domestic values for VAM. By end of the week prices were assessed around Rs.75/Kg for Kandla port and for Mumbai port.

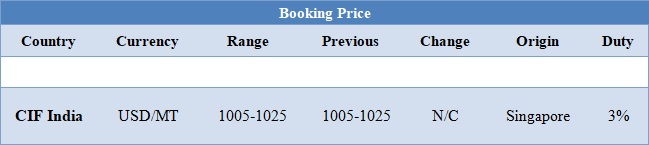

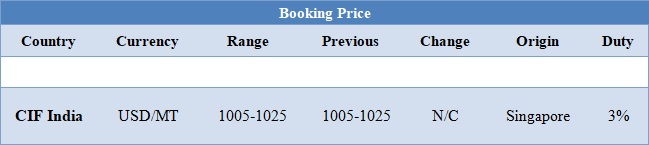

Booking Scenario

The above chart shows the international prices for Vinyl Acetate Monomer. International prices of VAM remained stable for this week in compare to last Friday’s assessed level.

INDIA & INTERNATIONAL

- VAM prices were assessed at the level of Rs.75/Kg at Kandla and for Mumbai port for bulk quantity.

- On other side, CFR India values remained stable for this week. Prices were assessed in the range of USD 1005-1025/MTS, with no change in compare to last week’s closing values.

- On other side there has been no change in values in Acetic Acid market. Prices were assessed in the range of USD 640-660/MTS.

- Market remained stable in the first week of this new year 2018. There has been no change in domestic values.

- There has been significant upsurge in crude values in international market. Current values are all time high in last one year. The political tension in Iran has been augmenting the hike in crude values.

- This week oil prices have remained little volatile but overall closed on higher note. On Thursday U.S. crude oil prices rise to the highest level in 2½ years as markets tightening amid tensions in Iran and due to ongoing OPEC-led production cuts.

- On Thursday, closing crude values have increased. WTI on NYME closed at $62.01/bbl; prices have increased by $0.38/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.23/bbl in compared to last trading and was assessed around $68.07/bbl.

- As per market analyst, the market is getting more bullish on oil as inventory levels get closer to the five-year average. Geopolitical uncertainty in Iran, OPEC's third largest producer, is also helping to support the price as citizens are again protesting the government.

$1 = Rs. 63.37

Import Custom Ex. Rate USD/ INR: 64.50

Export Custom Ex. Rate USD/ INR: 62.80