Vinyl Acetate Monomer Weekly Report 07 July 2018

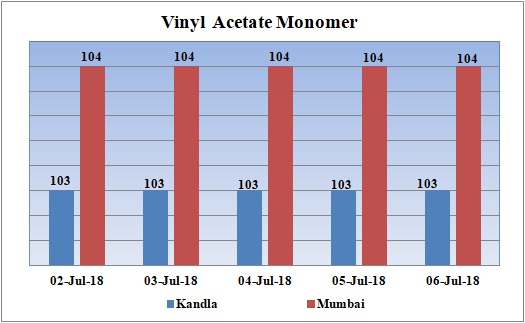

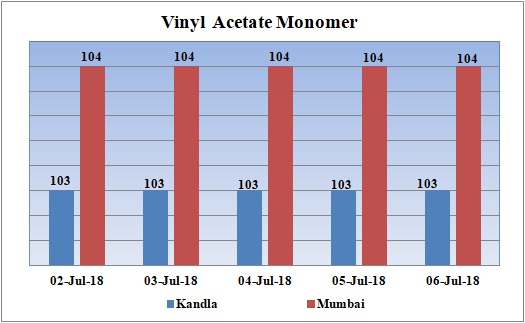

Weekly Price Trend: 02-07-2018 to 06-07-2018

- The graph above focuses on the Vinyl Acetate Monomer price trend for the current week.

- Prices have reduced slightly in domestic market on back of improved supply coupled with slight stable in the prices of Acetic Acid.

- By end of the week prices were assessed around Rs.103/Kg for Kandla port and Rs.104/Kg for Mumbai port.

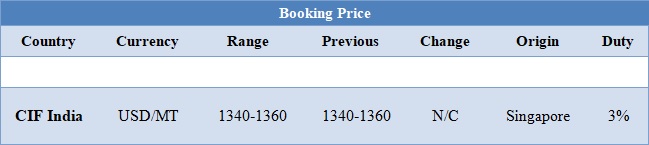

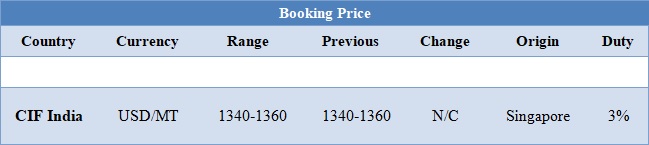

Booking Scenario

The above chart shows the international prices for Vinyl Acetate Monomer. International prices of VAM increased heavily again for this week. VAM with zero duty was available at USD 1350/MT in for traders.

INDIA & INTERNATIONAL

- VAM prices were assessed at the level of Rs.103/Kg at Kandla and Rs. 107/Kg for Mumbai port bulk quantity.

- With slowdown in supply in of chemical, domestic prices has now reduced for this week.

- Moreover monsoon has started in India. The western part of India is receiving heavy rainfall which in turn has led to slowdown in imports along with limited supply.

- In monsoon season the end consumer prefers limited material as most of the work gets affected due to heavy rainfall and stocking issue and other limited supply from importer.

- This week oil prices have followed volatile trend. On Thursday Oil fell after U.S. President Donald Trump demanded OPEC cut crude prices, but the market found some support from an Iranian threat to block shipments through the Strait of Hormuz.

- On Thursday, closing crude values have plunged. WTI on NYME closed at $72.94/bbl; prices have plunged by $1.20/bbl in compared to last closing prices. While Brent on Inter Continental Exchange plunged by $ 0.37/bbl in compare to last closing price and was assessed around $77.39/bbl.

- OPEC and Russia said in June they were willing to raise output to address concerns of supply shortages due to unplanned disruptions from Venezuela to Libya, and likely also to replace a potential fall in Iranian supplies due to U.S. sanctions. Despite these measures, Goldman Sachs said to client that "the market will remain in deficit" in the second half of the year.

$1 = Rs. 68.87

Import Custom Ex. Rate USD/ INR: 69.70

Export Custom Ex. Rate USD/ INR: 68.00