Vinyl Acetate Monomer Weekly Report 13 May 2017

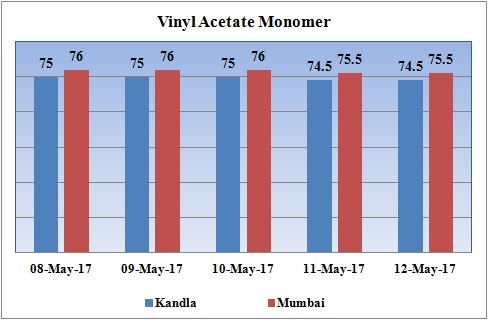

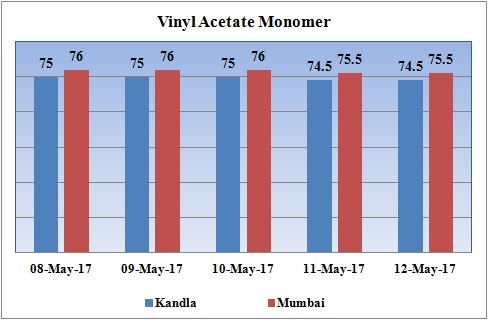

Weekly Price Trend: 08-05-2017 to 12-05-2017

- The graph above focuses on the Vinyl Acetate Monomer price trend for the current week.

- VAM prices followed an mixed trend throughout this week. In compare to other petrochemicals there has been slight decline in domestic values for VAM throughout this week.

- By end of the week prices were assessed around Rs.74.5/Kg for Kandla port and Rs.75.5/Kg for Mumbai port.

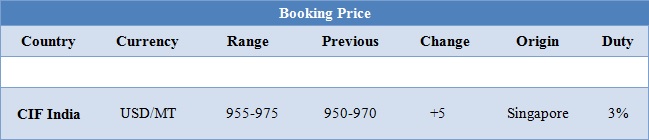

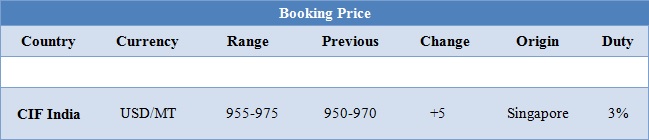

Booking Scenario

The above chart shows the international prices for Vinyl Acetate Monomer. International prices of VAM increased slightly for this week in compare to last Friday’s assessed level.

INDIA & INTERNATIONAL

- VAM prices were assessed at the level of Rs.74.5/Kg at Kandla and Rs.75.5/Kg with slight decline in domestic prices.

- On other side, CFR India values increased slightly for this week. Prices were assessed in the range of USD 950-970/MTS, with an increase of USD 5/MTS in compare to last week’s closing values.

- Global petrochemical manufacturer Celanese Corporations has increased the list and off-list selling prices for VAM in Asia. The prices increased has been CNY 300/tonne for East China,CNY350/tonne for South China and USD 100/tonne for Asia outside China.

- Celanese Corporation is a global technology leader in the production of specialty chemicals and products of consumer applications. The unit is based in Dallas in US having net sales of USD 5.4 billion.

- This week oil prices pushed up with minute plunge. Last week U.S. crude stockpiles posted their biggest drawdown since December as imports dropped sharply, while inventories of refined products also fell, helping boost oil prices that have been weighed down by concerns about oversupply.

- On Wednesday oil prices began looking higher after a string of positive data on oil stocks in the US helped to improve the market mood.

- As per reports, drop in the prices was seen which was beyond expectation and fuel stocks received the initial bullish attention. Adding to the positive tone was the reduction in imports.

- According to report a large part of the excess supply extended which in turn led to the shortage in the storage facilities.

- However, continued rebalancing in the oil market by year-end will require the collective efforts of all oil producers to increase market stability, not only for the benefit of the individual countries, but also for the general prosperity of the world economy, As per report.

- OPEC is due to meet later this month in the hope of striking a second deal to secure a year of production cuts. The twelve member states will be joined by Russia, but US production remains a concern.

- On Thursday, closing crude values have increased.WTI on NYME closed at $47.83/bbl, prices have increased by $0.50/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.55/bbl in compared to last trading and was assessed around $50.77/bbl.

$1 = Rs. 64.30

Import Custom Ex. Rate USD/ INR: 65.10

Export Custom Ex. Rate USD/ INR: 63.40