Vinyl Acetate Monomer Weekly Report 30 Dec 2017

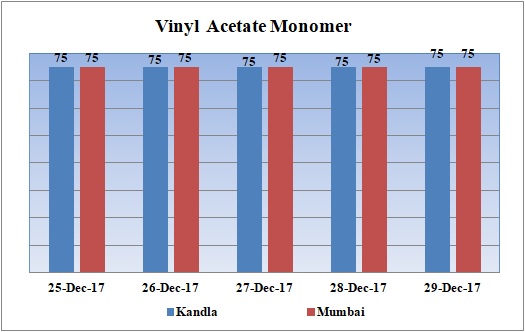

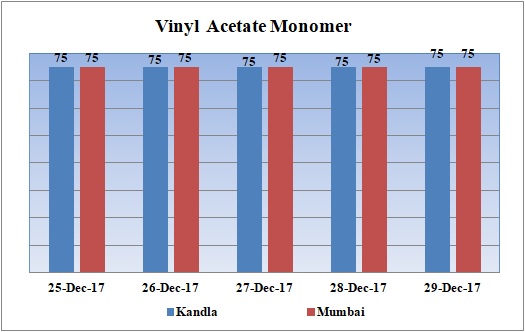

Weekly Price Trend: 25-12-2017 to 29-12-2017

- The graph above focuses on the Vinyl Acetate Monomer price trend for the current week.

- There has been slight change in domestic values for VAM. By end of the week prices were assessed around Rs.75/Kg for Kandla port and for Mumbai port.

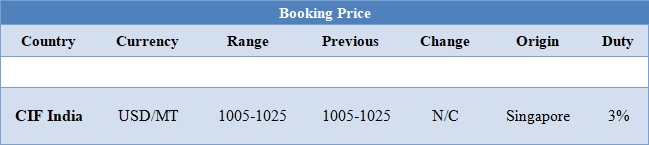

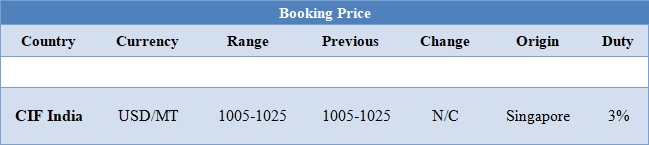

Booking Scenario

The above chart shows the international prices for Vinyl Acetate Monomer. International prices of VAM remained stable for this week in compare to last Friday’s assessed level.

INDIA & INTERNATIONAL

- VAM prices were assessed at the level of Rs.75/Kg at Kandla and for Mumbai port for bulk quantity.

- On other side, CFR India values remained stable for this week. Prices were assessed in the range of USD 1005-1025/MTS, with no change in compare to last week’s closing values.

- On other side there has been no change in values in Acetic Acid market. Prices were assessed in the range of USD 640-660/MTS.

This week crude oil prices have remained fluctuating. As 2017 draws to a close, On Thursday oil prices increased on lifted by strong data from top importer China and on increased U.S. refining activity that drew more crude from inventories. Recently, thin trading activity ahead of the New Year weekend.

As per report, market condition has been tight due to ongoing supply cuts led by OPEC, as well as top producer Russia.

On Thursday, closing crude values have increased. WTI on NYME closed at $59.84/bbl; prices have increased by $0.20/bbl in compared to last closing prices. While Brent on Inter Continental Exchange increased by $0.28/bbl in compared to last trading and was assessed around $66.72/bbl.

As per market analyst, In the first half of 2018, market will remain quite bullish as Saudi Arabia continues to signal its intent to privatize part of Saudi Aramco, the state-owned oil company, in an initial public offering expected in late 2018. As such, the Saudis will be quite motivated to keep prices up going into that sale. The risk to that outlook could become apparent if Russia stops cooperating, which has been a significant tipping factor in the cuts' effectiveness.

$1 = Rs. 63.87

Import Custom Ex. Rate USD/ INR: 64.90

Export Custom Ex. Rate USD/ INR: 63.20